Kharon helps leading organizations identify a wide range of sanctions and compliance risks critical to managing financial crimes, supply chain exposure, export controls, investment risk, and more.

See the whole picture

The premier global risk analytics platform.

Trusted by the world’s leading organizations

EMPOWERING INDUSTRY LEADERS WORLDWIDE

Our Clients Include:

Our Products are Powered by The Kharon Core

Insight unleashed

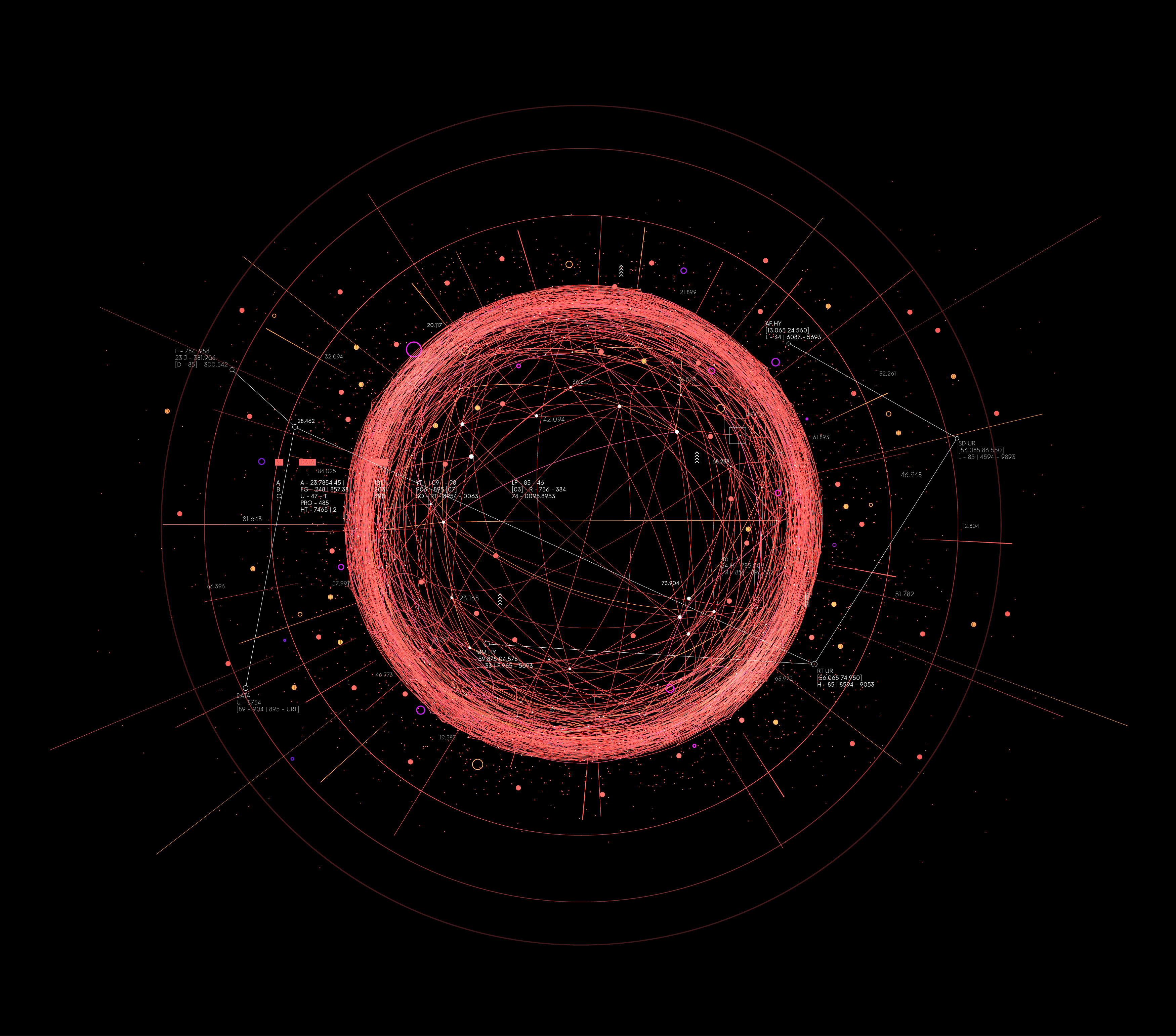

The Kharon Core

kharon product

Kharon Core

The power to transform industry

Expert analysts and advanced technology come together, producing a limitless supply of crucial insight through comprehensive research, real-time analysis, data science, and carefully engineered information architecture.

kharon product

ClearView

Expertise made effortless.

Strategic insights at lightning speed.

World-class data combined with a powerful visual analytics engine that gives you an unrivaled 360-degree view of your business risk.

Follow the thread.

Instantly separate risk from opportunity, and understand the broader networks surrounding specific entities and individuals that impact your business.

Superior data. Transformational results.

The ultimate tool for KYC, investigations, and analysis. Protect your business and stakeholders from individuals or entities associated with sanctioned or trade-restricted parties.

Superior data. Transformational results.

The ultimate tool for KYC, investigations, and analysis. Protect your business and stakeholders from individuals or entities associated with sanctioned or trade-restricted parties.

kharon product

GraphCast

INSIGHTS HARMONIZED TO YOUR BUSINESS

No compromises.

Supercharge your existing screening, analytics and AI systems with the most comprehensive risk intelligence data available.

It’s more than data.

It’s targeted insights critical for your business and use case, straight from the Kharon Core. Whether looking for insights on sanctions ownership or control, forced labor, Russia, military end use, evasion tactics, or more.

Optimized decision making.

Seamless and essential insights that let you act quickly and confidently.

kharon product

The Brief

Constant Insight Currency

Never miss an issue.

The world’s top analysts leveraging an industry-leading intelligence platform, giving you exclusive perspective on the topics that matter most.

Get smarter in minutes.

Complete coverage and expert analysis, delivered in a succinct briefing.

Read what matters.

Hand-picked insights covering the intersection of global security and commerce.

Never miss an issue.

The world’s top analysts leveraging an industry-leading intelligence platform, giving you exclusive perspective on the topics that matter most.

Solutions

The world’s best data wherever you need it.

Our industry-leading research methodology combines the world’s top analysts and data scientists with powerful technology, giving you unparalleled visibility across various industries, geographies, and risk typologies.

Testimonials

Real Insight. Real Impact.

See how we've helped transform the risk and compliance functions at the world's leading organizations.

"Kharon’s Forced Labor data gives us the clarity we need to make fast, confident decisions in a complex regulatory environment. Our team estimates that over the course of one week, screening insights would’ve taken 80 hours of labor-intensive work across multiple sources of information. With Kharon, we completed the same review in just 16 hours, freeing up time and resources for our other priorities.”

“Performing thorough due diligence on customers and suppliers is increasingly important for companies with a global footprint. Kharon ClearView enables us to do that more efficiently by giving us instant mapping of corporate ownership and affiliations for the entities with whom we do business. The ClearView system frees up time and resources we would otherwise need for researching publicly available information.”

Life at Kharon

Where Passion Creates Progress.

Discover a dynamic and challenging work environment where you can make a real impact and join us in identifying the complex risks of today's world.

Contact

Get in Touch

Connect with us today to inquire about our solutions, products, data, or a partnership collaboration.We look forward to hearing

from you.