Data

Crypto

Crypto

Data

Crypto

Crypto Risk Compliance & Management

Identifying sanctions and financial crimes risk on the blockchain requires access to relevant off-chain risk intelligence. Kharon’s crypto solutions enable virtual asset service providers (VASPs), and those with crypto holdings or exposure, to pinpoint material risk beyond what is on the chain. From compliance programs built from the ground up to enhancing existing programs, Kharon’s crypto solutions address expanding regulatory expectations while mitigating increased risk.

Risk Analysis for Crypto Financial Crimes

From off-chain to on-chain, Kharon’s crypto solutions allow enterprises to understand and manage their crypto-related risk to stay ahead of the regulatory curve. Kharon provides unique and focused data covering the networks surrounding sanctioned, trade restricted, and other high-risk actors across every global jurisdiction, including associated crypto accounts and businesses. Kharon collects, validates, and analyzes all reliable open-source documentation — corporate records, securities and regulatory filings, company websites and press releases, global media, and social media, among others — empowering your on-chain investigations with critical off-chain risk intelligence.

Kharon’s know-your-customer, sanctions, and risk data powers the largest crypto exchanges in the world.

Kharon’s know-your-customer, sanctions, and risk data powers the largest crypto exchanges in the world.

+SANCTIONED PARTIES + JURISDICTIONS

+THOUSANDS OF HIGH-RISK ENTITIES

+HIDDEN RELATIONSHIPS

- Wallets owned or controlled by sanctioned or trade-restricted entities

- Cryptocurrency operations in sanctioned jurisdictions

- Businesses, entities, and individuals connected to sanctioned or trade-restricted crypto actors

- Identifiers, such as emails and phone numbers, for sanctioned and other trade-restricted entities or actors

- NFTs connected to sanctioned or trade-restricted crypto networks

+EXPERT ANALYSIS

+SPECIALIZED DATA

+REDUCED OPERATIONAL COSTS

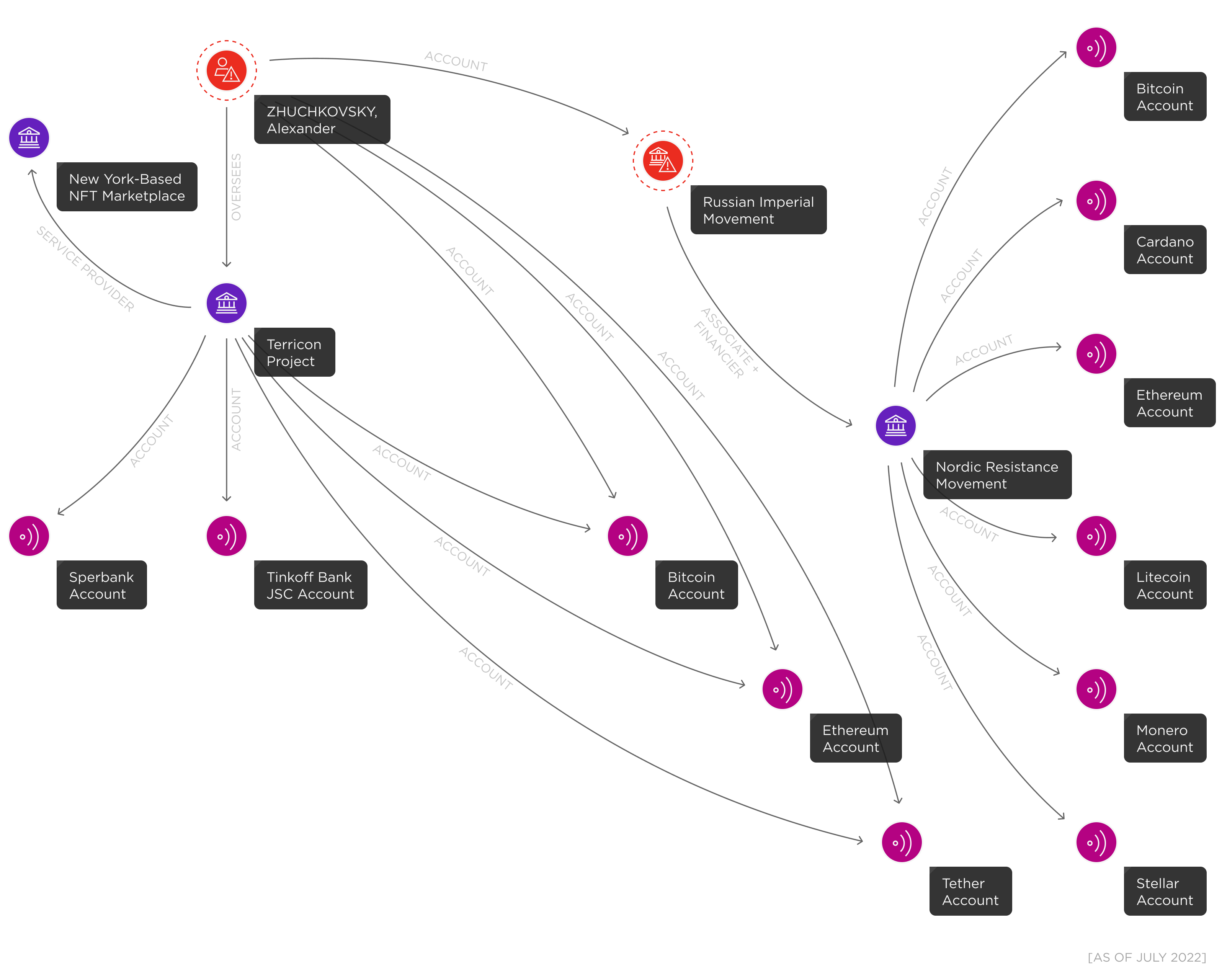

CASE STUDY: CRYPTOCURRENCY EXPOSURE

Illicit networks utilize cryptocurrencies as a means to raise and move funds. Governments, law enforcement, and regulatory regimes have been targeting these networks with new guidance for institutions operating within both cryptocurrency and traditional financial systems.

This case study highlights how Alexander Zhuchkovsky, sanctioned by the U.S. government as a Specially Designated Global Terrorist for his support of the Russian Imperial Movement (RIM), uses crypto services to store and transfer funds. Zuchkovsky runs and promotes the so-called Terricon Project to raise funds for Russian troops in Ukraine via crypto donations. Terricon Project’s website states that its use of cryptocurrency can help evade international sanctions. The Terricon Project has also utilized a New York-based non-fungible tokens (NFTs) marketplace to host NFTs used for additional RIM fundraising.

Additionally, the Nordic Resistance Movement — an affiliate of RIM — also hosts a number of crypto wallets (Bitcoin, Etherum, LiteCoin, and more).

This case study highlights how Alexander Zhuchkovsky, sanctioned by the U.S. government as a Specially Designated Global Terrorist for his support of the Russian Imperial Movement (RIM), uses crypto services to store and transfer funds. Zuchkovsky runs and promotes the so-called Terricon Project to raise funds for Russian troops in Ukraine via crypto donations. Terricon Project’s website states that its use of cryptocurrency can help evade international sanctions. The Terricon Project has also utilized a New York-based non-fungible tokens (NFTs) marketplace to host NFTs used for additional RIM fundraising.

Additionally, the Nordic Resistance Movement — an affiliate of RIM — also hosts a number of crypto wallets (Bitcoin, Etherum, LiteCoin, and more).

Want a Demo?

Trusted by the world’s leading organizations