Investment Intel columns analyze risks, opportunities and storylines worth watching in the markets, powered by Kharon insights and research.

As the Chinese battery giant CATL prepared for its secondary offering in Hong Kong last month, major U.S. banks lined up behind it. The result was the world’s largest equity offering of the year, worth $4.6 billion USD.

Another top Chinese company, Chery Automobile, is nearing its own Hong Kong IPO; the anticipated haul is around $1.5 billion USD. Wall Street walked away.

Why did U.S. banks ride CATL while leaving Chery unpicked? In China’s surging and all-important automotive industry, deals are sensitive to a range of competing risks and rewards. The promise of CATL’s higher fees was one factor in play.

But it wasn’t the only one.

A CATL Call for Capital

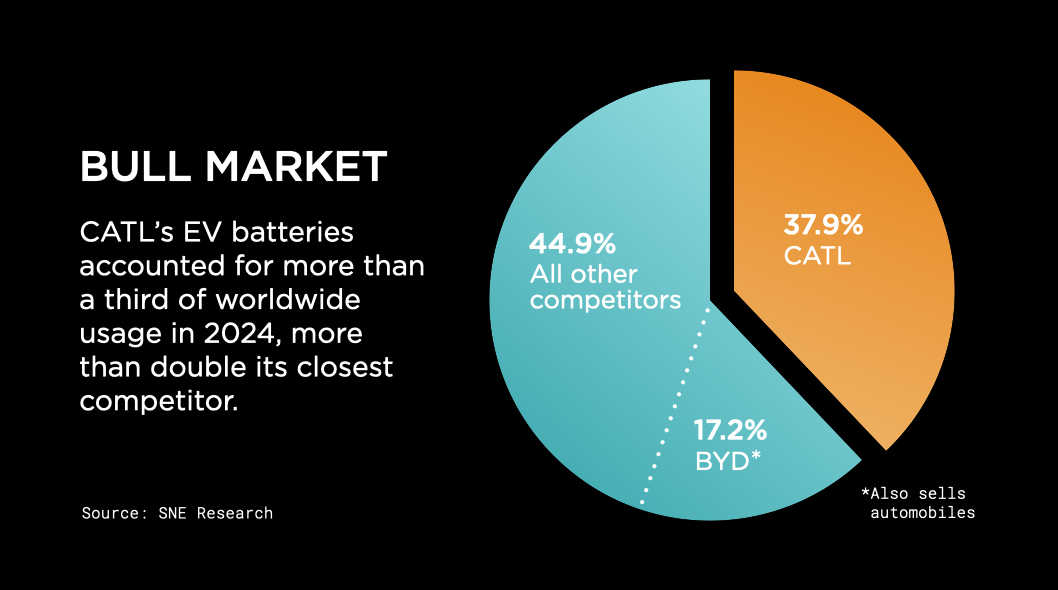

Primer: CATL (short for Contemporary Amperex Technology) is the world’s largest EV battery producer, accounting for 38% of the global market in 2024 while selling to a range of Western and Asian auto manufacturers.

As the Chinese battery giant CATL prepared for its secondary offering in Hong Kong last month, major U.S. banks lined up behind it. The result was the world’s largest equity offering of the year, worth $4.6 billion USD.

Another top Chinese company, Chery Automobile, is nearing its own Hong Kong IPO; the anticipated haul is around $1.5 billion USD. Wall Street walked away.

Why did U.S. banks ride CATL while leaving Chery unpicked? In China’s surging and all-important automotive industry, deals are sensitive to a range of competing risks and rewards. The promise of CATL’s higher fees was one factor in play.

But it wasn’t the only one.

A CATL Call for Capital

Primer: CATL (short for Contemporary Amperex Technology) is the world’s largest EV battery producer, accounting for 38% of the global market in 2024 while selling to a range of Western and Asian auto manufacturers.

CATL’s singular focus on lithium-ion batteries has allowed it to grow operating margins close to 20%, well above the standard operating margins of auto manufacturers, which are typically in the mid-single-digit range. Through CATL, investors gain exposure to the building blocks supporting EV growth and avoid the risks associated with one-off auto brands.

U.S.-based investors couldn’t participate in the new Hong Kong listing, but JP Morgan and Bank of America both sponsored it, despite pressure to drop the deal from the House Select Committee on the Chinese Communist Party. Demand was strong: The size of the sale was increased by 15%, and the price achieved was HK$263 per share, the top of the pre-advertised range.

Topline risks: CATL is exposed to sanctions and security challenges beyond its 1260H classification. It has an EV partnership, for instance, with the U.S.-sanctioned Chinese tech giant Huawei. And lithium batteries, besides in EVs, have also become crucial in various military applications, including large-scale vehicles and aircraft. CATL has announced batteries for commercial heavy-duty vehicles and is developing them for commercial aircraft; the potential for military cross-pollination no doubt factors into its 1260H classification.

Another CATL investment risk centers on forced labor in the Xinjiang region of China. The Uyghur Forced Labor Prevention Act (UFLPA) bars goods that are produced even partly in Xinjiang unless the importer can prove they weren’t made with forced labor.

Kharon findings: These kinds of risks from suppliers go back years for CATL, our research shows.

One of CATL’s electronic component suppliers owns Hubei Yihong Precision Manufacturing, which a CCP website implicated in a Xinjiang labor-transfer scheme in 2018. A 2020 CCP press release said that Yihong Precision Manufacturing had “educated and guided” Xinjiang employees through ideological trainings administered by a municipal branch of the CCP’s United Front Work Department, which is involved in the Chinese cultural assimilation of ethnic minorities.

CATL also has a 10-year purchase agreement to buy cathode material products used in batteries from Yibin Libode New Material Co., Ltd. Yibin Libode is minority-owned and supplied by Yibin Tianyuan Group, a chlor-alkali chemicals company that has joint ventures with the Xinjiang Production and Construction Corps (XPCC), a paramilitary group that the United States sanctioned in 2020 for human rights abuses against Uyghurs.

The House committee called out both Yibin Tianyuan Group and the XPCC in its letter, nearly a year before CATL’s successful Hong Kong offering.

Chery and its Pits

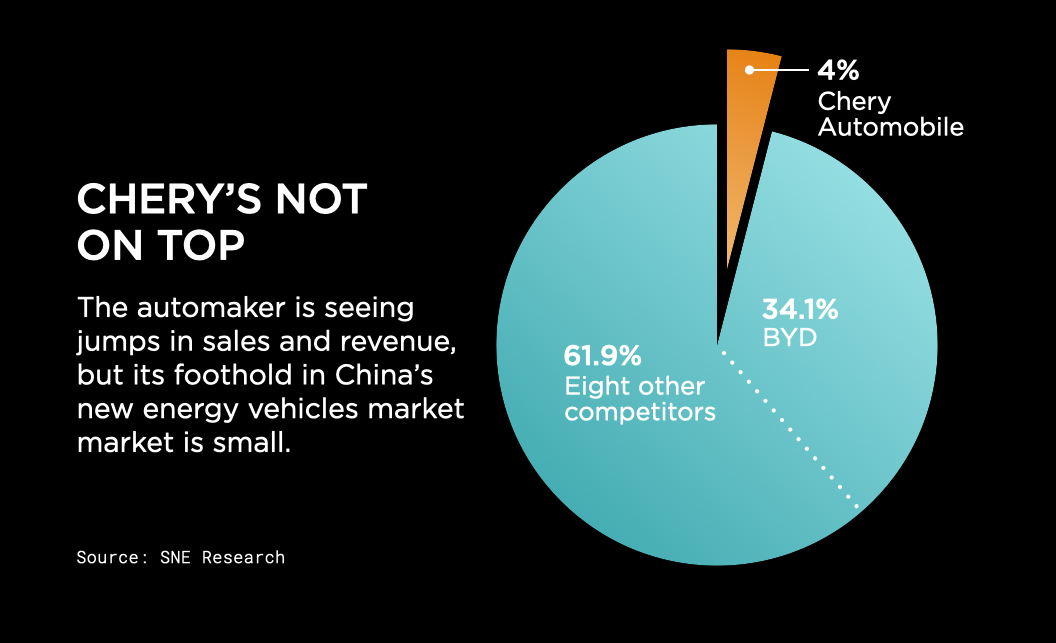

Primer: Chery Automobile is a state-owned Chinese automaker headquartered in Wuhu, Anhui. For more than two decades now, according to its prospectus, it’s been the No. 1 exporter among Chinese passenger-vehicle companies.

But Chery is also a mid-market Chinese auto brand in an extremely crowded, competitive and capital-intensive environment. While CATL can boast economies of scale, technology leadership and tight integration with leading equipment manufacturers, Chery’s enduring competitive advantages are harder to discern. Its net profit margins linger in the mid-single digits, well below CATL’s and a clear signal to would-be investors of a relatively weak market position. That picture no doubt impacted U.S. banks’ decision to withdraw IPO support.

- But CATL has faced U.S. scrutiny. The Department of Defense added it in January to its 1260H list of Chinese military companies, temporarily denting CATL’s stock in China by 6%.

- The 1260H list doesn’t yet impose direct restrictions, but it will underpin staggered DOD procurement controls beginning in 2026. In the meantime, members of Congress have referenced the list to enact restrictions against listed companies and their subsidiaries.

U.S.-based investors couldn’t participate in the new Hong Kong listing, but JP Morgan and Bank of America both sponsored it, despite pressure to drop the deal from the House Select Committee on the Chinese Communist Party. Demand was strong: The size of the sale was increased by 15%, and the price achieved was HK$263 per share, the top of the pre-advertised range.

Topline risks: CATL is exposed to sanctions and security challenges beyond its 1260H classification. It has an EV partnership, for instance, with the U.S.-sanctioned Chinese tech giant Huawei. And lithium batteries, besides in EVs, have also become crucial in various military applications, including large-scale vehicles and aircraft. CATL has announced batteries for commercial heavy-duty vehicles and is developing them for commercial aircraft; the potential for military cross-pollination no doubt factors into its 1260H classification.

Another CATL investment risk centers on forced labor in the Xinjiang region of China. The Uyghur Forced Labor Prevention Act (UFLPA) bars goods that are produced even partly in Xinjiang unless the importer can prove they weren’t made with forced labor.

- Chinese auto shipments have been under heightened UFLPA scrutiny since the start of the fiscal year, Kharon has previously reported.

Kharon findings: These kinds of risks from suppliers go back years for CATL, our research shows.

One of CATL’s electronic component suppliers owns Hubei Yihong Precision Manufacturing, which a CCP website implicated in a Xinjiang labor-transfer scheme in 2018. A 2020 CCP press release said that Yihong Precision Manufacturing had “educated and guided” Xinjiang employees through ideological trainings administered by a municipal branch of the CCP’s United Front Work Department, which is involved in the Chinese cultural assimilation of ethnic minorities.

CATL also has a 10-year purchase agreement to buy cathode material products used in batteries from Yibin Libode New Material Co., Ltd. Yibin Libode is minority-owned and supplied by Yibin Tianyuan Group, a chlor-alkali chemicals company that has joint ventures with the Xinjiang Production and Construction Corps (XPCC), a paramilitary group that the United States sanctioned in 2020 for human rights abuses against Uyghurs.

The House committee called out both Yibin Tianyuan Group and the XPCC in its letter, nearly a year before CATL’s successful Hong Kong offering.

Chery and its Pits

Primer: Chery Automobile is a state-owned Chinese automaker headquartered in Wuhu, Anhui. For more than two decades now, according to its prospectus, it’s been the No. 1 exporter among Chinese passenger-vehicle companies.

But Chery is also a mid-market Chinese auto brand in an extremely crowded, competitive and capital-intensive environment. While CATL can boast economies of scale, technology leadership and tight integration with leading equipment manufacturers, Chery’s enduring competitive advantages are harder to discern. Its net profit margins linger in the mid-single digits, well below CATL’s and a clear signal to would-be investors of a relatively weak market position. That picture no doubt impacted U.S. banks’ decision to withdraw IPO support.

The listing: Chery’s Hong Kong IPO, which could raise $1.5 billion USD, is being led by an all-Chinese cohort of financial institutions. Bloomberg reported last month that JP Morgan is no longer on the deal, after Chery had picked it in late 2024 to work on the offering.

Topline risks: Chery isn’t on the 1260H list like CATL. But its extensive dealings in sanctioned markets, coupled with its diminished pricing power, made it a tougher sell for U.S. banks.

In Chery’s IPO prospectus, the term “sanction” appears almost 150 times. Management seems to have tried to respond to banks’ concerns, including by pulling Chery from Iran and Cuba in December. Its prospectus said that it would “downscale our operation and sales in Russia to mitigate sanctions risks,” too. That would be a big shift.

But Chery still derived almost a third of its revenue from Russia in 2023, the year after the full-scale invasion of Ukraine. And it has relied on assembly partners, including the U.S.-sanctioned Russian automaker AvtoVAZ, for its exports of partially assembled products to Russia.

Kharon findings: Chery also has lingering links to China’s military-industrial complex that might not immediately be obvious to investors.

In an apparent effort to distance itself from that world, Chery recently scaled back its ties to Wuhu Shipyard Co., Ltd., which has built hundreds of advanced naval combat ships. In 2024, Wuhu won bids to supply various units of the People’s Liberation Army.

Chery Holding Group, the parent of Chery Automobile, owned a majority stake in Wuhu Shipyard until January. Following a restructuring, ownership of the shipyard was distributed among 11 entities—but around one-third of it, we found, still remains linked to Chery, both through its founder and chairman and through a major stakeholder.

In brief

From a sanctions and security perspective, Chery and CATL both sail close to the wind. Their contrasting receptions from U.S. banks reflect the trade-offs between geopolitical risks and commercial upside.

Read more from Kharon:

Topline risks: Chery isn’t on the 1260H list like CATL. But its extensive dealings in sanctioned markets, coupled with its diminished pricing power, made it a tougher sell for U.S. banks.

In Chery’s IPO prospectus, the term “sanction” appears almost 150 times. Management seems to have tried to respond to banks’ concerns, including by pulling Chery from Iran and Cuba in December. Its prospectus said that it would “downscale our operation and sales in Russia to mitigate sanctions risks,” too. That would be a big shift.

But Chery still derived almost a third of its revenue from Russia in 2023, the year after the full-scale invasion of Ukraine. And it has relied on assembly partners, including the U.S.-sanctioned Russian automaker AvtoVAZ, for its exports of partially assembled products to Russia.

Kharon findings: Chery also has lingering links to China’s military-industrial complex that might not immediately be obvious to investors.

In an apparent effort to distance itself from that world, Chery recently scaled back its ties to Wuhu Shipyard Co., Ltd., which has built hundreds of advanced naval combat ships. In 2024, Wuhu won bids to supply various units of the People’s Liberation Army.

Chery Holding Group, the parent of Chery Automobile, owned a majority stake in Wuhu Shipyard until January. Following a restructuring, ownership of the shipyard was distributed among 11 entities—but around one-third of it, we found, still remains linked to Chery, both through its founder and chairman and through a major stakeholder.

In brief

From a sanctions and security perspective, Chery and CATL both sail close to the wind. Their contrasting receptions from U.S. banks reflect the trade-offs between geopolitical risks and commercial upside.

Read more from Kharon: