Today’s compliance landscape is shaped by complexity. Risk often emerges not only from a single party, but from the web of relationships that link entities together. From sanctioned entities to hidden supply chain links, many risks don’t exist in plain sight. Solutions limited to simple list matches or ultimate-owner snapshots can’t capture the dynamic ownership layers and network connections essential for modern risk management. This leaves organizations bogged down in manual reviews and false positives, instead of focusing their efforts where real risk exists.

Outdated KYC and screening databases don’t just slow investigations or drive up costs—they may fail to generate alerts in the first place, leaving critical risks undetected and uninvestigated.

By using Kharon’s web-based search and data visualization platform, ClearView, compliance teams are streamlining investigations and reviews, and shifting resources from manual research to higher-value analysis.

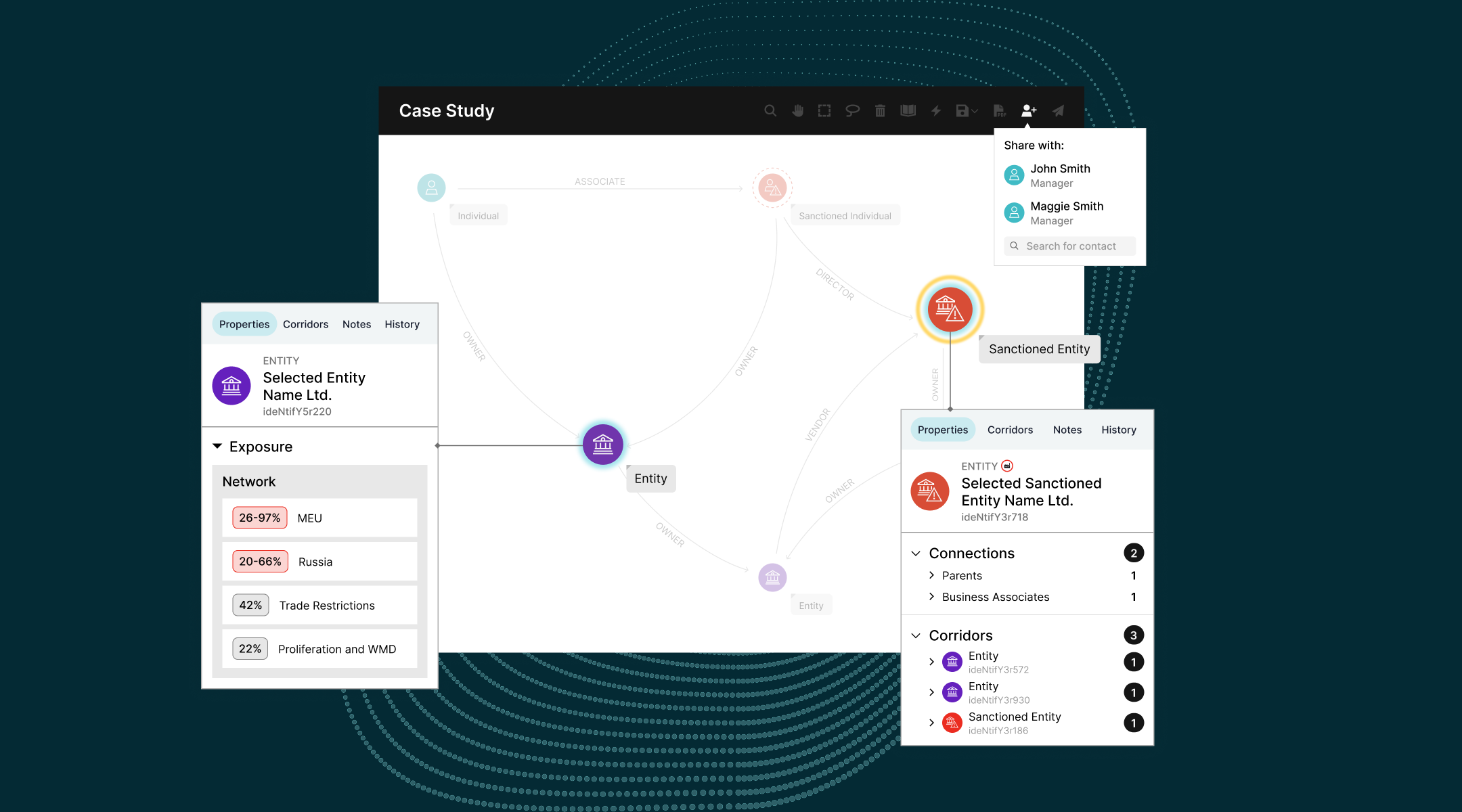

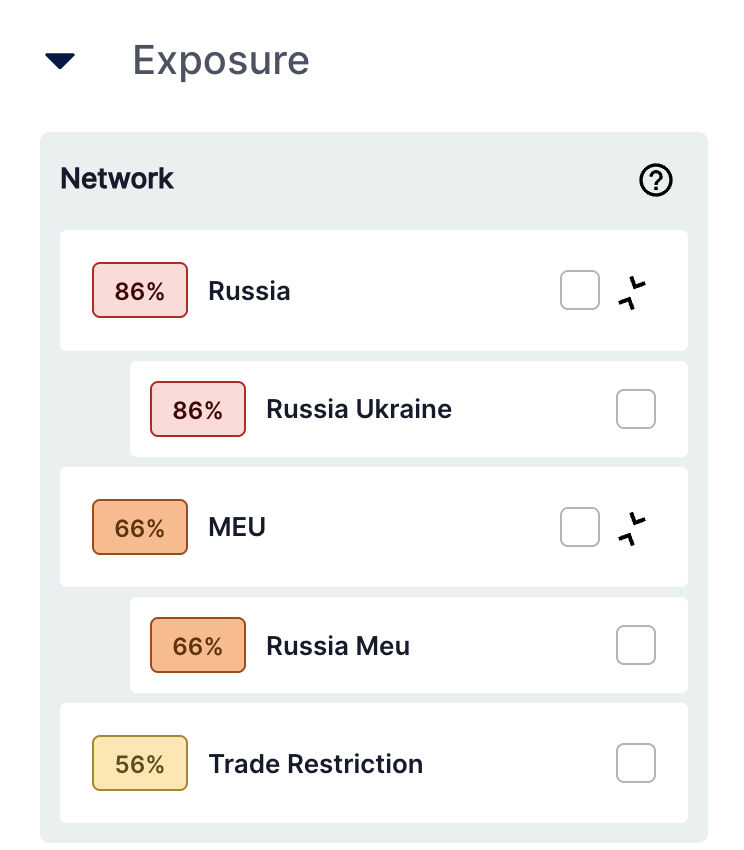

ClearView provides visual relationship mapping and contextual risk insights. With ClearView’s Dynamic Exposure Scores and risk visualization capabilities, teams gain instant insight into the risk across networks of entities. By mapping relationships visually, ClearView delivers the essential context needed to make faster, smarter, and more defensible compliance-related decisions.

These hidden relationships pose serious compliance risks. Without visibility into indirect or layered connections, organizations may unintentionally engage with sanctioned or trade-restricted parties, exposing themselves to:

But when additional risks are buried in indirect connections, spread across multiple tiers of ownership, or derived from diverse information resources, profiles and UBO results fall short. They may flag potential risk, or miss it entirely, but rarely provide full context. This leaves teams without the transparency or source information needed to investigate relationships more deeply. Other providers may serve up the starting point for an investigation, Kharon uncovers the broader network of entities, ownership links, and related risk factors—helping teams surface and resolve cases faster and more accurately.

Outdated KYC and screening databases don’t just slow investigations or drive up costs—they may fail to generate alerts in the first place, leaving critical risks undetected and uninvestigated.

By using Kharon’s web-based search and data visualization platform, ClearView, compliance teams are streamlining investigations and reviews, and shifting resources from manual research to higher-value analysis.

ClearView provides visual relationship mapping and contextual risk insights. With ClearView’s Dynamic Exposure Scores and risk visualization capabilities, teams gain instant insight into the risk across networks of entities. By mapping relationships visually, ClearView delivers the essential context needed to make faster, smarter, and more defensible compliance-related decisions.

How Complex Relationships Hide Compliance Risks

High-risk entities and actors don’t operate in isolation. A primary challenge for organizations stems from the complex relationships that link them. For instance, while sanctioned actors are publicly listed by governments, entities that they own, control, or transact with often are not. A vendor or client that your institution is working with might appear low-risk until you trace its ownership up several levels and find a restricted parent company.These hidden relationships pose serious compliance risks. Without visibility into indirect or layered connections, organizations may unintentionally engage with sanctioned or trade-restricted parties, exposing themselves to:

- Regulatory or enforcement penalties, including hefty fines

- Reputational damage

- Loss of stakeholder confidence

The Limits of Traditional KYC and UBO Compliance Databases When Faced With Complex Risk Networks

Legacy KYC databases often rely on profile-based outputs drawn from unverified adverse media, offering static information about individual entities—such as names, or basic risk flags. Separately, tools that focus exclusively on corporate registries or ultimate beneficial ownership (UBO) data may capture formal relationships but miss critical insights. While corporate registries and UBO data provide a starting point, they leave analysts with the burden of sourcing and stitching together additional information to build a full risk picture. On their own, these tools often miss complex networks—such as indirect ties to sanctioned parties, state-aligned actors, or high-risk affiliates—that fall outside ownership thresholds, are hidden through layered structures, or only emerge when combined with broader intelligence.But when additional risks are buried in indirect connections, spread across multiple tiers of ownership, or derived from diverse information resources, profiles and UBO results fall short. They may flag potential risk, or miss it entirely, but rarely provide full context. This leaves teams without the transparency or source information needed to investigate relationships more deeply. Other providers may serve up the starting point for an investigation, Kharon uncovers the broader network of entities, ownership links, and related risk factors—helping teams surface and resolve cases faster and more accurately.

With ClearView, you can quickly understand key details about an entity's broader network.

For instance, a legacy compliance tool might show a red-flagged profile for Entity A, based on adverse media mentions or inclusion on list. But ClearView shows the full story - that Entity A is indirectly owned by a restricted party through three intermediary subsidiaries - and also provides users with citations indicating where that information was drawn from.

ClearView helps compliance teams understand how entities are connected to risk topics – like sanctions and trade restrictions – by combining interactive link charts with network-based analysis. By making complex risks visible and traceable, it streamlines investigations and strengthens decision-making.

One size does not fit all. Through GraphCast, Kharon delivers custom risk intelligence tailored to each institution’s priorities, risk appetite, and compliance thresholds. As regulatory expectations evolve and internal strategies shift, institutions can quickly adjust the data they receive—tuning for ownership percentage thresholds, risk typologies, geographic focus, and more. By calibrating exposure types and delivery logic to organizational needs, GraphCast helps prevent over-screening and enables more efficient, targeted alerting.

Kharon’s GraphCast data integrates seamlessly into existing compliance infrastructure—including screening platforms, case management systems, and other enterprise tools—with detailed risk labels that clarify the underlying reason for each match or alert. This ongoing refinement helps reduce false positives and prevent unnecessary alerts, allowing teams to focus on what truly matters.

Kharon’s data reflects ongoing changes in risk, including updates to ownership, control, and affiliations. For example, if an entity that is majority-owned by a sanctioned party subsequently changes its ownership structure to fall below the threshold for sanctions ownership – Kharon promptly removes the entity from its 50-Plus GraphCast screening file, preventing wasteful over-screening. At the same time, the entity’s current and former owners remain visible in Kharon’s ClearView application—with source citations provided for a complete audit trail.

Kharon also always seeks to include key identifying information on every record, allowing users of Kharon data to have full clarity on each party of interest.

This network-first approach enables compliance teams to quickly understand complex structures, trade activity, and other forms of connectivity—helping identify networks of concern and assess risk that hides in intricate network associations, that are routinely missed by KYC, corporate ownership and supply chain mapping databases.

How to Uncover Hidden Compliance Risks with Relationship Mapping Tools

ClearView goes beyond traditional compliance tools—such as adverse media, PEP, and ownership databases—by adding dynamic, visual relationship mapping and proprietary analytics that reveal hidden risks those services alone cannot surface. Rather than isolating individual entities, ClearView reveals the broader networks in which those entities operate, including indirect ties, affiliate relationships, and exposure that standard compliance datasets often miss.ClearView helps compliance teams understand how entities are connected to risk topics – like sanctions and trade restrictions – by combining interactive link charts with network-based analysis. By making complex risks visible and traceable, it streamlines investigations and strengthens decision-making.

Minimizing Screening Noise Through Context and Clarity

ClearView also works in tandem with GraphCast, Kharon’s data delivery solution that integrates enriched risk intelligence into screening systems, global trade platforms, supply chain tools, and more. GraphCast integrates risk data into screening platforms and connects alerts to deeper insights, enabling faster, more informed decisions within existing workflows. With a single click on a hit or result in a screening or other platform, users are taken into ClearView, where they can quickly explore the network context behind a flagged entity or individual—clarifying the source of risk and bridging the gap between initial alert and resolution.One size does not fit all. Through GraphCast, Kharon delivers custom risk intelligence tailored to each institution’s priorities, risk appetite, and compliance thresholds. As regulatory expectations evolve and internal strategies shift, institutions can quickly adjust the data they receive—tuning for ownership percentage thresholds, risk typologies, geographic focus, and more. By calibrating exposure types and delivery logic to organizational needs, GraphCast helps prevent over-screening and enables more efficient, targeted alerting.

Kharon’s GraphCast data integrates seamlessly into existing compliance infrastructure—including screening platforms, case management systems, and other enterprise tools—with detailed risk labels that clarify the underlying reason for each match or alert. This ongoing refinement helps reduce false positives and prevent unnecessary alerts, allowing teams to focus on what truly matters.

Kharon’s data reflects ongoing changes in risk, including updates to ownership, control, and affiliations. For example, if an entity that is majority-owned by a sanctioned party subsequently changes its ownership structure to fall below the threshold for sanctions ownership – Kharon promptly removes the entity from its 50-Plus GraphCast screening file, preventing wasteful over-screening. At the same time, the entity’s current and former owners remain visible in Kharon’s ClearView application—with source citations provided for a complete audit trail.

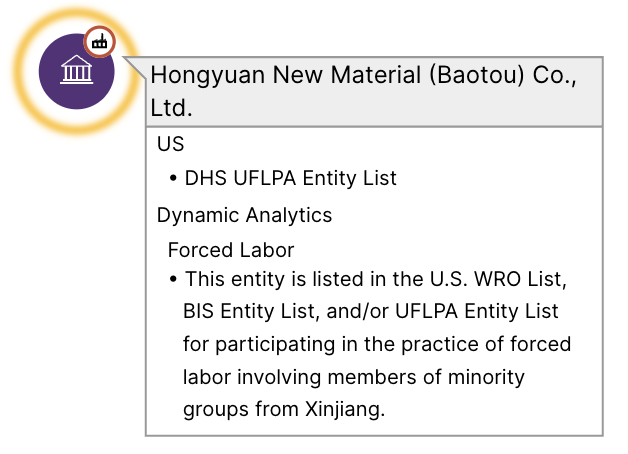

Kharon also always seeks to include key identifying information on every record, allowing users of Kharon data to have full clarity on each party of interest.

What is Relationship Mapping in Compliance?

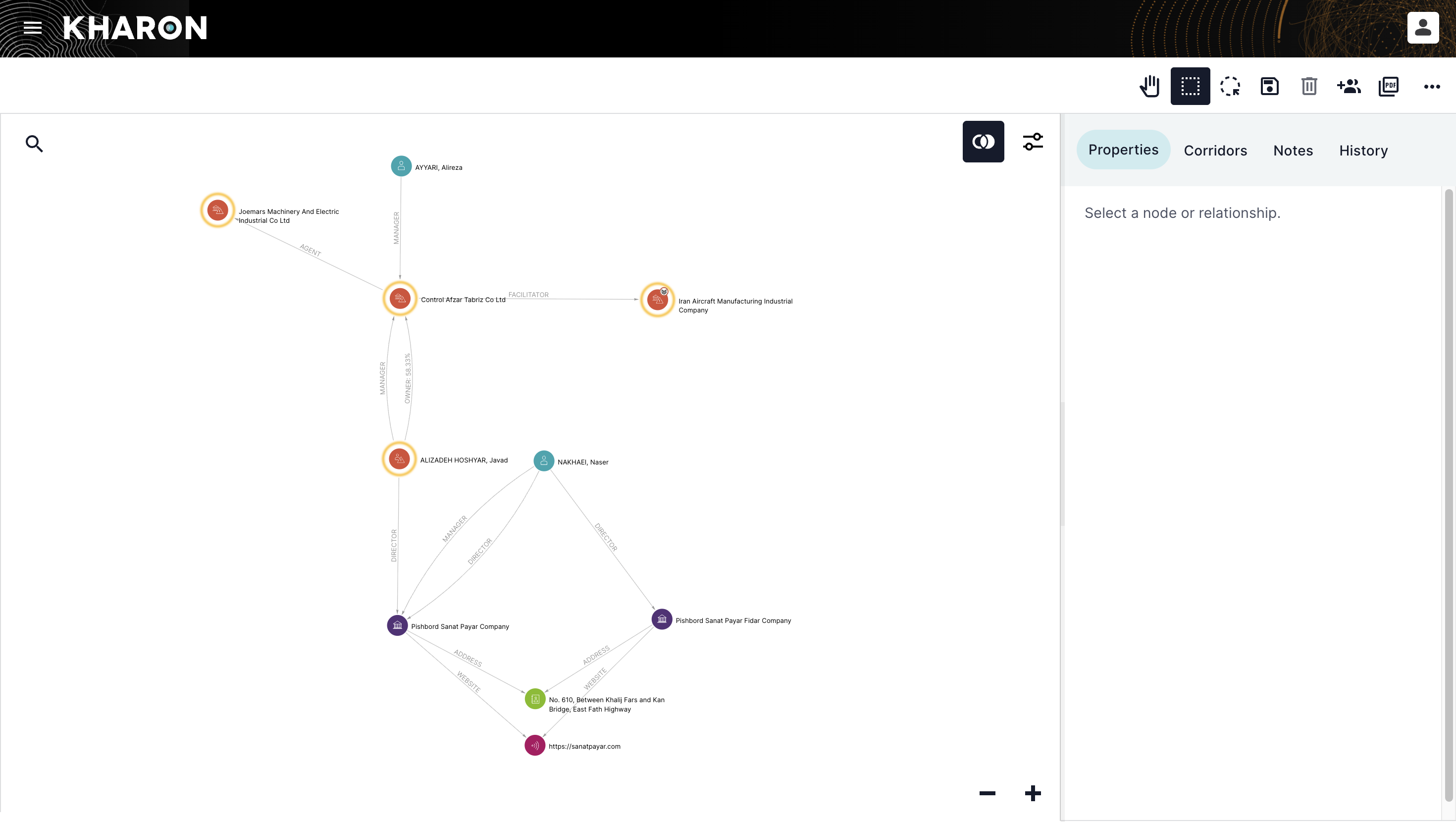

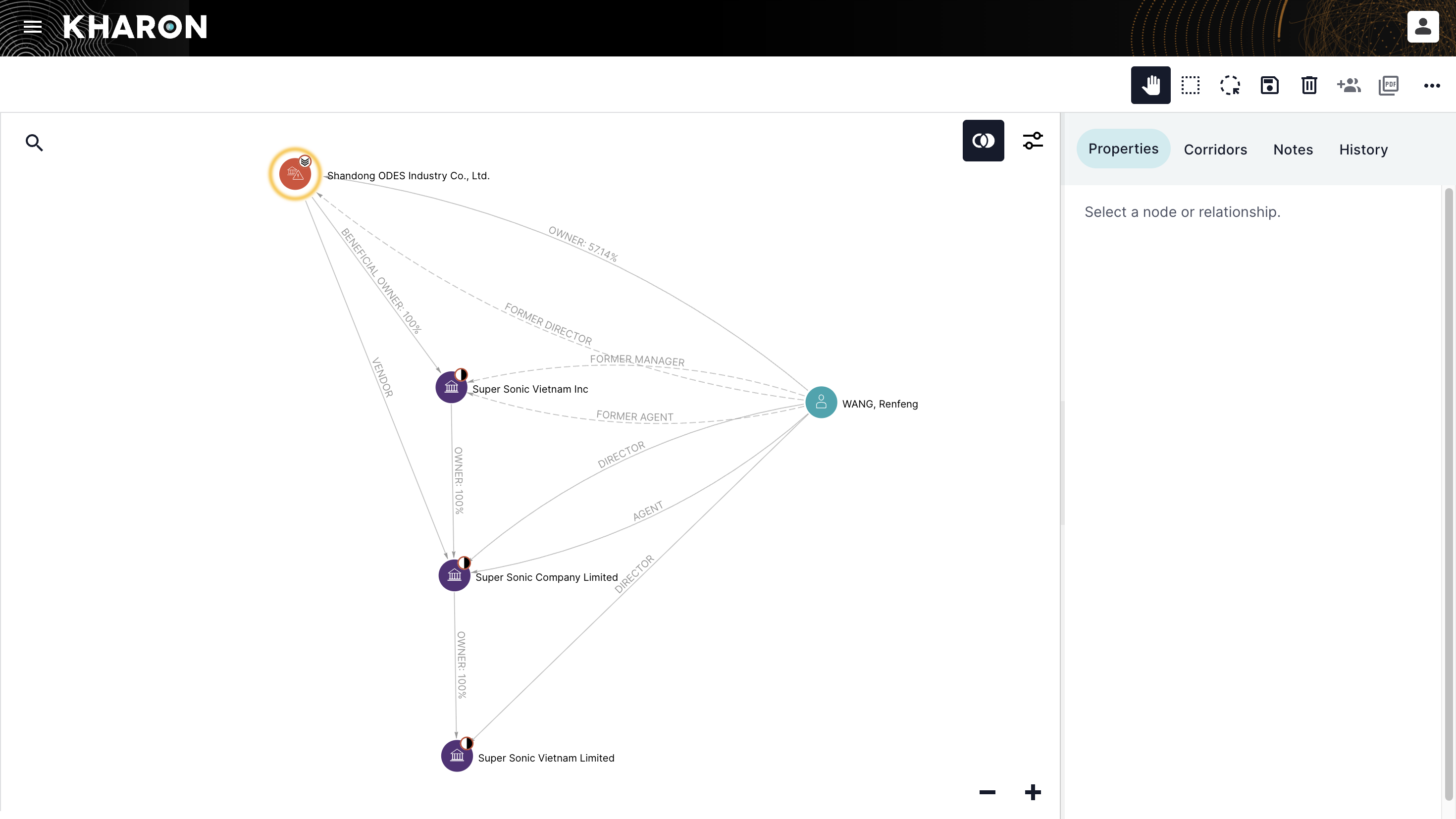

Kharon maps the full network of entities surrounding actors that are targeted by sanctions, trade controls and other national security restrictions. This mapping includes ownership, control, trade affiliations, and other high-risk linkages. This includes multi-layered upstream and downstream relationships as well as lateral ties where exposure can be risk-relevant. Every connection in Kharon’s data, as depicted in ClearView, is backed by expert vetted supporting source documentation.This network-first approach enables compliance teams to quickly understand complex structures, trade activity, and other forms of connectivity—helping identify networks of concern and assess risk that hides in intricate network associations, that are routinely missed by KYC, corporate ownership and supply chain mapping databases.

See and understand complex ownership structures, trade activity, and other relationships instantly.

How Can I Better Understand How Parties Exposed to Risk Networks Are Connected?

ClearView’s visualizations make it easy to see and understand exposure at a glance, whether it involves an entity or individual, and to quickly grasp how they fit into the broader risk landscape. Parties are displayed as nodes within a connected network, not isolated profiles—each marked with visual indicators of risk, such as sanctioned ownership, ties to watchlisted actors, or operations in high-risk jurisdictions. If you’re investigating a party that isn’t restricted itself but is linked, directly or indirectly, to a high-risk actor, those connections are visually clear and immediately surfaced.

Understand an entity's key risk indicators in ClearView.

How Are Risk Scores Calculated and Explained?

ClearView’s Dynamic Exposure Scores analyze the full network of an entity to generate a transparent, explainable risk score. These scores are built on rich data covering sanctions, export controls, forced labor, and other global security risks, going well beyond traditional adverse media and ownership data. Kharon’s proprietary platform powered by AI, data analytics, and expert input analyzes complex relationships and risk indicators to produce a single, understandable score.The scores provide an indication of the level of exposure a party may have to a range of risk topics and are paired with visual explanations of the underlying factors, ensuring transparency. For example, if you’re reviewing a person or entity with exposure to Russia sanctions, military end use, or proliferation concerns, the score highlights the level of risk and ClearView instantly shows the specific ownership links, trade activity, or other relationships that explain why.

Dynamic Exposure Scores give immediate insights into complex relationships by isolating and weighting key pathways to sources of risk, providing a precise score based on exposure levels, and offering visual explanations that underpin the score.

How ClearView Enhances Compliance Workflows

From onboarding and investigations to ongoing risk monitoring, ClearView enhances transparency and precision at every stage of the compliance workflow where it is applied. It tracks a broad spectrum of risk factors, including sanctions exposure, export controls red flags, forced labor, and affiliations with restricted military end-users. This makes it an essential tool for teams working across financial crime compliance, supply chain integrity, regulatory due diligence, and broader risk analysis.The sections below outline key applications where ClearView adds value across compliance functions.

Account Opening

ClearView enhances account opening workflows by uncovering risks at the very first point of customer engagement. By mapping indirect ownership, affiliated entities, and jurisdictional exposure that might not appear in standard checks, ClearView helps institutions make faster, better-informed onboarding decisions. This early-stage visibility reduces the likelihood of downstream issues, ensuring that high-risk relationships are identified and addressed before accounts are approved.

KYC Compliance

ClearView enables teams to quickly surface and visualize high-risk relationships surrounding a customer or counterparty, including indirect ownership, transactional ties, sanctioned affiliates, and connections to restricted parties or jurisdictions that may not be visible in standard profiles. ClearView also enhances KYC compliance by providing deeper visibility into high-risk customer networks, enabling faster, more informed decision-making.

Sanctions Screening

ClearView strengthens sanctions compliance by enabling users to move beyond basic list-matching or UBO searches to quickly and comprehensively assess exposure to listed and unlisted sanctioned actors, even when it’s indirect, layered, or multiple steps removed from listed parties.

Supply Chain Mapping

ClearView supports proactive supply chain risk management by illuminating high-risk connections well beyond direct and tier-2 or tier-3 suppliers. Organizations can trace complex networks to uncover hidden links to trade-restricted or sanctioned entities, enabling informed decision-making and stronger, more effective due diligence.

MEU Screening

For companies navigating export controls and military end-use (MEU) restrictions, Kharon’s data identifies entities with military affiliations or ties to restricted end users. ClearView brings this intelligence to life, enabling users to visualize trade activity, ownership links, and other risk factors that may signal MEU exposure. This helps teams quickly understand the context behind potential concerns and supports more confident, well-documented decision-making.

Investigations

ClearView powers and accelerates deep-dive investigations by exposing the networks of parties that surround and support sanctioned, trade-restricted, or otherwise risk-relevant actors. Kharon’s data and insights – which crosses jurisdictions, cover all reliable sources of data, and connect seemingly unrelated entities through shared risk markers – going beyond just adverse media and PEPs data, which remain the focus of legacy providers. Kharon highlights a wider degree of possible connectivity between parties and sources of risk. Namely, Kharon ClearView allows investigators to see a full 360-degree view of a network, whether the risks in question involve ownership, control, commercial exposure, co-location, shared management, or other material associations.

Risk Analysis

ClearView provides critical support for broader risk analysis, whether assessing a single entity or a set of counterparties. By surfacing expansive - often hidden - connections, such as sanctioned ownership, proximity to high-risk actors, or jurisdictional exposure, ClearView helps teams prioritize which parties warrant further review and focus their investigative resources where it matters most.

See Kharon ClearView in Action

Modern compliance teams face the daunting challenge of navigating a complex web of global regulations and interconnected risks. Traditional methods aren’t designed to meet the complexity of today’s compliance landscape, leaving organizations vulnerable to financial penalties, reputational damage, and operational disruptions.Kharon ClearView addresses these challenges by providing a dynamic visualization platform that transforms raw data into actionable intelligence. It gives organizations the tools they need to act quickly, accurately, and confidently.

With Kharon’s ClearView platform, you can:

- Map complex networks with transparency and precision

- Visualize entity relationships and risk markers in real time

- Streamline investigations and reduce false positives

- Instantly understand relative risk via Dynamic Exposure Scores

- Through GraphCast, connect screening alerts to deep, contextual analysis

- Build auditable, defensible compliance programs

- Readily export and share analyses within colleagues or decision makers

- Consult directly with Kharon subject matter experts on findings or questions within a workspace

See how leading teams use relationship mapping to uncover hidden threats. Request a demo to see ClearView in action.