Rethinking Compliance: From Cost Center to Strategic Investment

Compliance and risk leaders often face a tough question: What is the return on investment (ROI) of introducing advanced risk intelligence to our compliance program? From financial crime and sanctions to export controls, compliance functions are essential for preventing regulatory issues, enforcement actions, and operational disruptions. But their value extends far beyond risk avoidance. A well-run compliance program infused with risk intelligence creates operational efficiencies in the form of reduced overhead and time to decision. It also enhances enterprise value — by protecting reputation, strengthening investor confidence, and equipping leadership with the insight to make smarter, bolder decisions.The ROI of compliance isn’t just measured in fines avoided, but in the stability, strategic flexibility, and long-term growth it enables.

Meanwhile, regulatory requirements are growing more complex… and more costly.

To secure resources and executive alignment, organizations should frame compliance not merely as a defensive function, but as an investment — one that pays off when implemented with intention. Strategically implemented compliance programs generate real business value: from cost savings and reduced legal exposure, to improved efficiency, greater operational resilience, and the protection of brand and franchise value.

Here, we'll break down the key costs of compliance, explain how to demonstrate ROI, and showcase the tangible benefits of investing in advanced risk intelligence solutions like Kharon.

Compliance Costs and Their Business Impact: What's at Stake

Compliance costs span a wide range of line items:- Personnel: First line of defense, operations teams, compliance officers, analysts, legal counsel

- Technology: Screening systems, case management tools, data subscriptions

- Training: Educating staff on policies, risks, and how to perform their roles effectively

- Audits and reporting: Internal and third-party assessments, record keeping

- Enforcement: Costs of remediating violations or responding to inquiries

However, the indirect costs of not implementing a strong compliance program can carry broader operational and strategic consequences:

- Operational delays: Shipment holds, slowed product development and sales cycles, investigation backlogs

- Reputational damage: Negative media exposure, partner distrust, consumer backlash

- Revenue loss: Blocked transactions, lost deals, paused expansion plans

These realities underscore why compliance must be treated as an investment. Instead of viewing compliance budgets as mere cost centers, organizations can build a case for how effective compliance prevents losses, unlocks efficiencies, and enables growth. It can also be leveraged to create a competitive advantage.

Why Proving ROI Matters in Today’s Compliance Landscape

Compliance officers need to demonstrate and prove the ROI of compliance, and justify proactive investments, due to:- Rising regulatory complexity: From Office of Foreign Assets Control (OFAC) sanctions to the Outbound Investment Security Program (OISP) rule and EU Export Controls, for example, companies face more rules across more jurisdictions — as well as higher stakes.

- The cost of non-compliance: Between 2014 and 2024, OFAC issued nearly $5 billion in fines for sanctions violations. A single enforcement action can be more costly than years of compliance spend.

- Board and investor scrutiny: Leadership wants to know that compliance is protecting the business and that spend is justified, which provides them with confidence in the company's risk management and mitigation strategies.

- Cross-departmental alignment: Legal, finance, operations, and compliance must speak a shared language of risk and return, and a data-driven ROI narrative helps secure budget, streamline cross-team priorities, and strengthen an organization’s risk posture.

Using Metrics to Establish the Value of Risk Intelligence

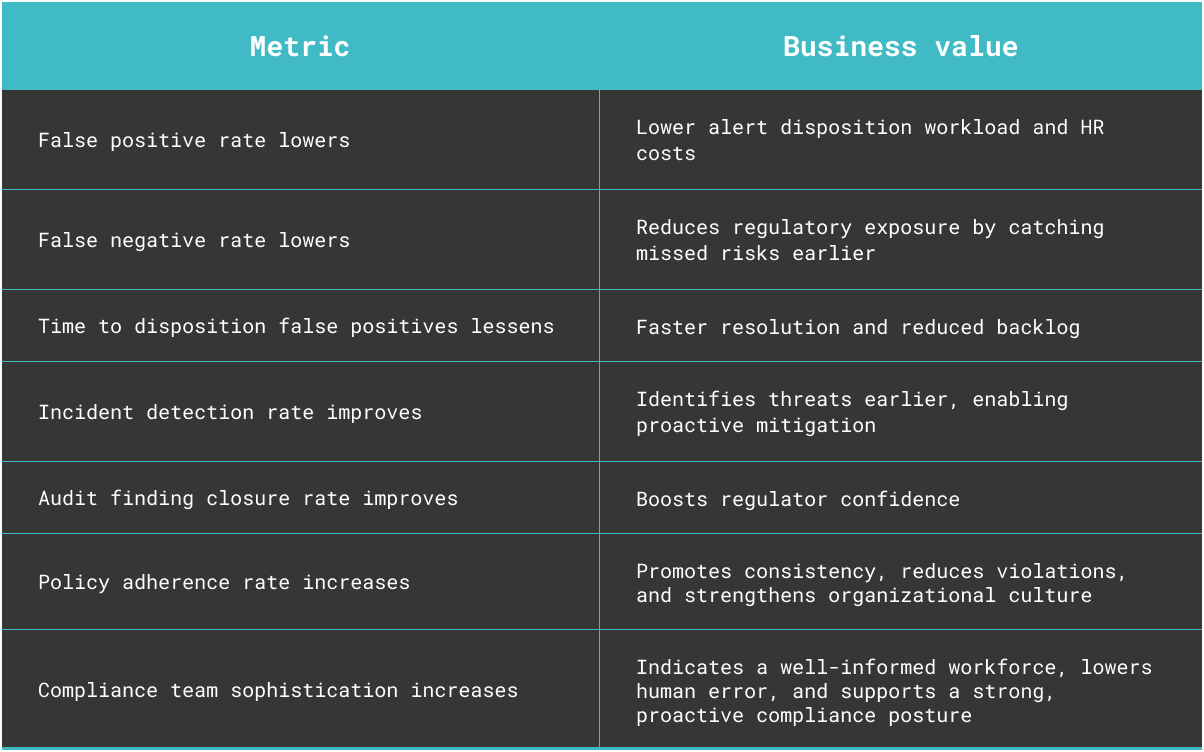

To demonstrate compliance ROI and make the case for the introduction of risk intelligence, an effective path forward can be to link operational metrics to outcomes valued by leadership.

How Risk Intelligence Investments Deliver Tangible Value

Compliance programs may also yield less tangible — but still valuable — benefits. Examples include stronger performance during regulatory examinations, as well as a boost in confidence among external stakeholders.Moreover, investing in risk intelligence can be a distinct competitive advantage. By proactively mitigating risks and avoiding negative public attention — the kind that competitors can exploit — organizations can maintain a positive market standing and differentiate themselves through their commitment to responsible and secure operations.

Ultimately, a strong compliance framework contributes to an organization's overall stability and reputation. Advanced risk intelligence platforms like Kharon don’t just support compliance — they strengthen the business.

Building a Business Case for Compliance and Risk Intelligence

Boards and C-suites are under increasing regulatory scrutiny for oversight failures related to compliance and risk. A strong culture of compliance is one of the most effective controls in a high-risk environment, as it supports governance, mitigates board liability, promotes ethical conduct, and strengthens an organization’s long-term market position. To gain leadership buy-in, here are key steps and considerations for justifying adding risk intelligence to your compliance budget with a clear ROI narrative:- Assess metrics that demonstrate business impact — for example, false positive rates, average investigation or resolution time, audit findings, incidents averted — and convert them into dollars or other key measures of value.

- Paint clear scenarios and utilize threat modeling to illustrate potential outcomes with and without the proposed investment. Evaluate the potential cost of not doing enough, to include legal, financial, and reputational risks.

- Align compliance investments with both regulatory expectations and strategic business goals. Show how advanced risk intelligence tools help ensure real-time compliance with evolving regulatory expectations while keeping the company audit-ready.

- Leverage industry benchmarks by referencing peers and data. What are best-in-class peers doing, and what penalties have others paid for falling short?

- Include qualitative gains, such as brand protection and strengthened trust with partners.

Here’s how to structure your pitch:

- Current state: Compliance gaps, inefficiencies, risks

- Opportunity: Introduction of advanced risk intelligence into risk management framework

- ROI evidence: Projected cost savings, loss avoidance, and efficiency gains

- Strategic fit: Supports {company goal}

Demonstrate the Value of Compliance with Kharon

True enhancement of a compliance program, one that provides substantial ROI to an enterprise, is only possible with high-quality, actionable data — and that’s where Kharon delivers a clear advantage. Built by subject matter experts, leveraging advanced analytics, and grounded in regulatory understanding, Kharon’s risk intelligence platform helps compliance teams detect risk earlier, act faster, and communicate value with confidence.Whether you’re screening for sanctions exposure, navigating global trade, or vetting investments, Kharon equips teams with the insights needed to build defensible risk management programs.

With Kharon, organizations can:

- Cut alert noise across every screening program: Leverage enriched data and analytics to slash false positive rates and speed up alert resolution in KYC, CDD/EDD, trade finance, securities, supply chain, and third-party risk controls.

- Expose hidden linkages: Surface minority or layered ownership, board and management ties, joint ventures, supply chain nodes, and other hard-to-spot relationships, the Office of the Comptroller of the Currency (OCC) highlights as critical in effective risk assessments.

- Fortify all pillars of financial crime compliance: Address sanctions, export controls, UFLPA/forced labor, AML, anti-bribery and corruption, and other FCC mandates with a single, consistently structured intelligence source.

- Stay ahead of audits, exams, and enforcement: Document robust governance, close internal audit findings faster, and meet evolving regulatory expectations to prevent compliance gaps from escalating into enforcement actions.

- Demonstrate quantifiable ROI: Free up analyst capacity, accelerate onboarding and transaction decisions, safeguard revenue streams, and protect brand trust by preventing costly disruptions or penalties.