Investment Intel columns analyze risks, opportunities and storylines worth watching in the markets, powered by Kharon insights and research.

The U.S. sorely needs rare earths elements. China has a chokehold on them. Their strategic value has turned them into a key bargaining chip in the countries’ latest trade war, and that’s also the reason for the meteoric—if you will—rise of MP Materials.

Las Vegas-based MP is the largest producer of rare earth materials in the Western Hemisphere and, according to its 10-K filings last year, is the only mining and processing site of scale in North America. The U.S. Department of Defense last month rolled out support for the company worth hundreds of millions of dollars, turning MP into a stock darling with a market cap above $10 billion.

As long as tensions between the U.S. and China persist, government backing for companies that operate in this critical sector is likely to expand. So, who might be next?

NdPr metal is alloyed with other elements to produce the most powerful and efficient magnets available today, the kind that feed into cars, wind turbines and consumer electronics devices. NdPr magnets are also, importantly, sought after for defense applications, like in F-35 Lightning II aircraft, which require more than 900 pounds of rare earth elements, as the U.S. Department of Defense noted in a post last year.

It all makes MP’s rare earth minerals a hot commodity.

The U.S. sorely needs rare earths elements. China has a chokehold on them. Their strategic value has turned them into a key bargaining chip in the countries’ latest trade war, and that’s also the reason for the meteoric—if you will—rise of MP Materials.

Las Vegas-based MP is the largest producer of rare earth materials in the Western Hemisphere and, according to its 10-K filings last year, is the only mining and processing site of scale in North America. The U.S. Department of Defense last month rolled out support for the company worth hundreds of millions of dollars, turning MP into a stock darling with a market cap above $10 billion.

As long as tensions between the U.S. and China persist, government backing for companies that operate in this critical sector is likely to expand. So, who might be next?

MP Materials: A sudden stock star

Primer: Founded in 2017, MP Materials mines and processes seven of the 17 rare-earth elements, with a focus on the one that makes up the biggest slice of the market: Neodymium-Praseodymium (NdPr) oxide.NdPr metal is alloyed with other elements to produce the most powerful and efficient magnets available today, the kind that feed into cars, wind turbines and consumer electronics devices. NdPr magnets are also, importantly, sought after for defense applications, like in F-35 Lightning II aircraft, which require more than 900 pounds of rare earth elements, as the U.S. Department of Defense noted in a post last year.

It all makes MP’s rare earth minerals a hot commodity.

Building an F-35 jet takes hundreds of pounds of rare earth elements. (Adobe Stock Images)

Growth trajectory: From 2022 to 2024, 80% or more of MP Materials’ revenue came from a single Chinese customer: Shenghe Resources (SHZ 600392), a partly state-owned processor and large MP Materials shareholder. The trade war led MP “to cease shipments of rare earth concentrate to China,” it announced in April, but MP had been scaling up its business elsewhere.

After adding processing capabilities to its California mine, it began production last December of magnetic precursor products at its new Fort Worth, Tex., “Independence” facility. That prompted a flurry of prepayments from American customers. Magnet production is the goal by the end of this year.

Government intervention: U.S. officials have been wary of China’s stranglehold on rare earths for a while. In 2022, the U.S., EU and other allies announced a Minerals Security Partnership that aims to create “diverse, secure, and sustainable supply chains for critical minerals.” A U.S. Commerce Department report that same year explored the national security impacts of Neodymium magnet imports and recommended “bolster[ing] domestic supply.”

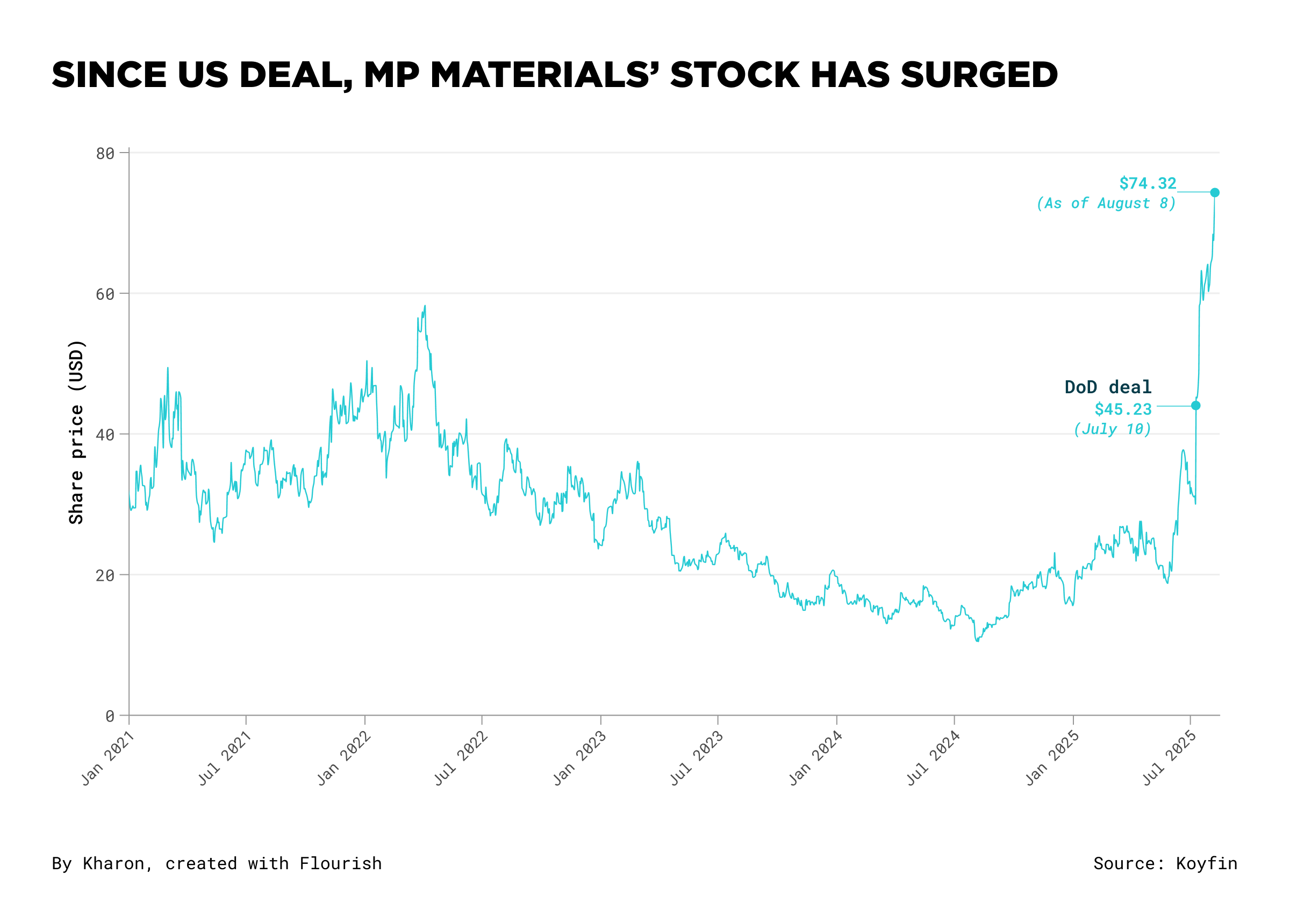

MP Materials is one beneficiary. In early July, it announced a new, $400 million deal with the Department of Defense. Central to the deal were a new magnet production facility and a couple striking details: a 10-year purchase agreement at fixed prices and a DoD investment that would make it MP’s largest shareholder.

“The price floor is the level of intervention you’d normally see in China,” Gracelin Baskaran, director of the critical minerals security program at the Center for Strategic and International Studies, told the Financial Times.

Apple followed DoD’s deal by signing a deal with MP Materials five days later centered on recycling. MP’s stock in recent weeks has responded with gusto.

After adding processing capabilities to its California mine, it began production last December of magnetic precursor products at its new Fort Worth, Tex., “Independence” facility. That prompted a flurry of prepayments from American customers. Magnet production is the goal by the end of this year.

Government intervention: U.S. officials have been wary of China’s stranglehold on rare earths for a while. In 2022, the U.S., EU and other allies announced a Minerals Security Partnership that aims to create “diverse, secure, and sustainable supply chains for critical minerals.” A U.S. Commerce Department report that same year explored the national security impacts of Neodymium magnet imports and recommended “bolster[ing] domestic supply.”

MP Materials is one beneficiary. In early July, it announced a new, $400 million deal with the Department of Defense. Central to the deal were a new magnet production facility and a couple striking details: a 10-year purchase agreement at fixed prices and a DoD investment that would make it MP’s largest shareholder.

“The price floor is the level of intervention you’d normally see in China,” Gracelin Baskaran, director of the critical minerals security program at the Center for Strategic and International Studies, told the Financial Times.

Apple followed DoD’s deal by signing a deal with MP Materials five days later centered on recycling. MP’s stock in recent weeks has responded with gusto.

Solvay: Unearthing opportunity

The value chain: China accounts for 70% of global rare-earths production and owns 90% of the world’s processing capabilities. Investing in new mines is notoriously risky: Regulatory hurdles are high, timelines are long and profitability can swing wildly. Besides mining, another entry point is the processing and recycling portions of the value chain, which are crucial for resource-poor regions to stay in the game.Europe contains no active rare earth element mines, but it has a resource-hungry automaking base, an increasing focus on defense and lofty circular economy ambitions. Against this backdrop, NdPr recycling and processing companies hold strategic significance. By 2030, the EU wants to process 40% of its critical minerals and source 25% from recycling.

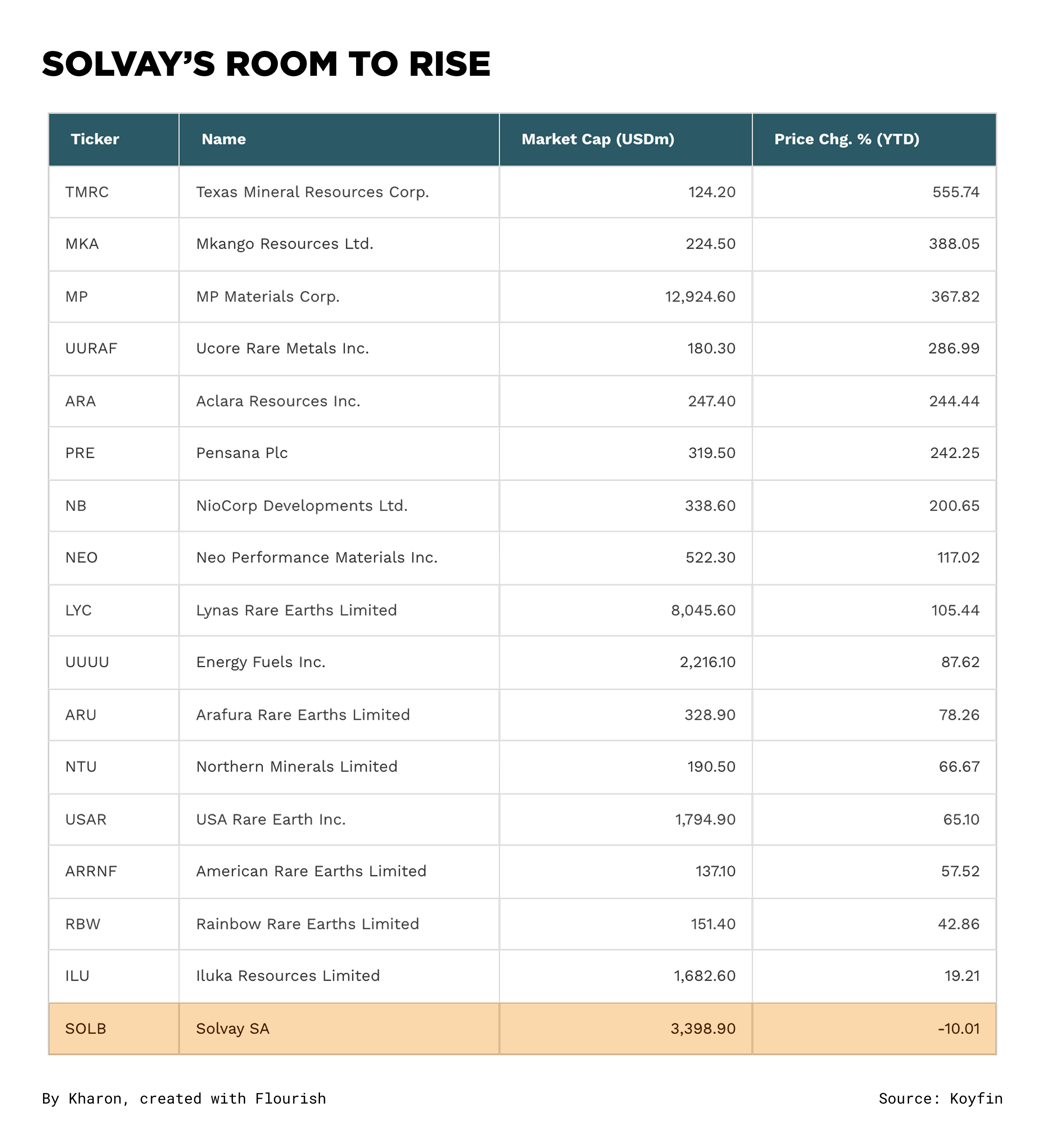

Name to watch: Solvay (SOLB.BR) is a longstanding Belgian chemical company that’s making a new rare-earths push. Unlike the rare earth mining prospectors, Solvay offers stable cash flows, as a midstream processing specialist renowned for its deep chemical and purification expertise.

In April, the company launched a new NdPr production line in France, using recycled feedstock from Ontario. Solvay’s ambition, it said, is to fulfill 30% of Europe’s magnet requirements by 2030.

“Customers are very interested, they know what’s at stake,” An Nuyttens, president of Solvay’s special chem business, told the FT in April. “They need this independence from China.”

What’s next: Rare earths comprised just 7% of Solvay’s revenue in 2024, and in May its chief executive described its magnet business line as “really very small at this point.” Given that, Solvay’s stock—which is close to its 10-year low—hasn’t yet been lifted like many of its peers in the space.

Its price-to-earnings ratio—an expression of future expectations—is also sitting only at 8x, significantly below its 10-15x historical range. The opportunity here doesn’t appear to be priced in.

But if Solvay can indeed hit 30% of Europe’s magnet needs, The Brief’s math suggests that would add $1 billion in revenue to Solvay’s top line by 2030, a 20% increase over 2025 levels. Fresh government deals like MP Materials’ could potentially follow in the years ahead.

What’s next: Neo, which sits at a market cap below $1 billion, expects “large-scale commercial production” in 2026, according to a recent earnings call. “Major” European automotive suppliers have already signed on as customers, it’s said, and Neo is targeting North American EV producers as well.

Its Estonia facility will aim to produce 5,000 tons per year of permanent magnets once fully scaled, the company said last month. The Brief estimates this could add up to 25% in additional revenue on top of Neo’s 2024 totals.

Downside: Governments’ intervention strategies can be a black box, and other market forces—such as the price of an underlying commodity—can weigh on stock prices for a long time before the cavalry of state support arrives.

More from the Kharon Brief:

But if Solvay can indeed hit 30% of Europe’s magnet needs, The Brief’s math suggests that would add $1 billion in revenue to Solvay’s top line by 2030, a 20% increase over 2025 levels. Fresh government deals like MP Materials’ could potentially follow in the years ahead.

- The EU has already lent support, after all, to another company on the rise in this space.

Neo Performance Materials: EU-boosted

Neo Performance Materials, headquartered in Toronto and listed on the Toronto Stock Exchange, rose from the ashes of the company that used to own MP Materials’ California mine. It specializes in rare metal processing and the manufacture of magnetic powders—and it, too, is expanding magnet production capabilities in Europe. Next month, Neo plans to bring a new rare-earth magnet facility, which the EU co-funded, online in Estonia.What’s next: Neo, which sits at a market cap below $1 billion, expects “large-scale commercial production” in 2026, according to a recent earnings call. “Major” European automotive suppliers have already signed on as customers, it’s said, and Neo is targeting North American EV producers as well.

Its Estonia facility will aim to produce 5,000 tons per year of permanent magnets once fully scaled, the company said last month. The Brief estimates this could add up to 25% in additional revenue on top of Neo’s 2024 totals.

What we’re watching

Upside: Strategically important sectors, especially with military exposure, that rely heavily on Chinese imports.Downside: Governments’ intervention strategies can be a black box, and other market forces—such as the price of an underlying commodity—can weigh on stock prices for a long time before the cavalry of state support arrives.

More from the Kharon Brief: