Investment Intel columns analyze risks, opportunities and storylines worth watching in the markets, powered by Kharon insights and research.

When the U.S. government proposed export controls on semiconductor design software to China in May, shares dropped sharply for two American companies, Synopsys and Cadence. Then, last week, the U.S. rolled the proposal back.

The all-important electronic design automation (EDA) market is dedicated to designing, verifying and monitoring semiconductor chips, and Synopsys and Cadence dominate it. The reversal spelled some immediate relief for both companies, who quickly announced that they were restoring access to their technology in China.

But the Brief suspects that further regulatory shocks lie ahead here, as U.S.-China tensions rage on.

One reason is U.S. EDA tech’s penetration into the Chinese market. Problem partners in China are another.

EDA primer: The complexity of modern microchips means they can’t be produced without advanced software, tooling and IP. EDA tools automate, simulate and verify the design process, making EDA vendors a key piece of the machine that builds the machine.

When the U.S. government proposed export controls on semiconductor design software to China in May, shares dropped sharply for two American companies, Synopsys and Cadence. Then, last week, the U.S. rolled the proposal back.

The all-important electronic design automation (EDA) market is dedicated to designing, verifying and monitoring semiconductor chips, and Synopsys and Cadence dominate it. The reversal spelled some immediate relief for both companies, who quickly announced that they were restoring access to their technology in China.

But the Brief suspects that further regulatory shocks lie ahead here, as U.S.-China tensions rage on.

One reason is U.S. EDA tech’s penetration into the Chinese market. Problem partners in China are another.

EDA primer: The complexity of modern microchips means they can’t be produced without advanced software, tooling and IP. EDA tools automate, simulate and verify the design process, making EDA vendors a key piece of the machine that builds the machine.

“There are two significant choke points [in the semiconductor supply chain]. One is always EDA, one is cap equipment.”

- Trey Campbell, Synopsys senior VP of investor relations, June 4, 2025

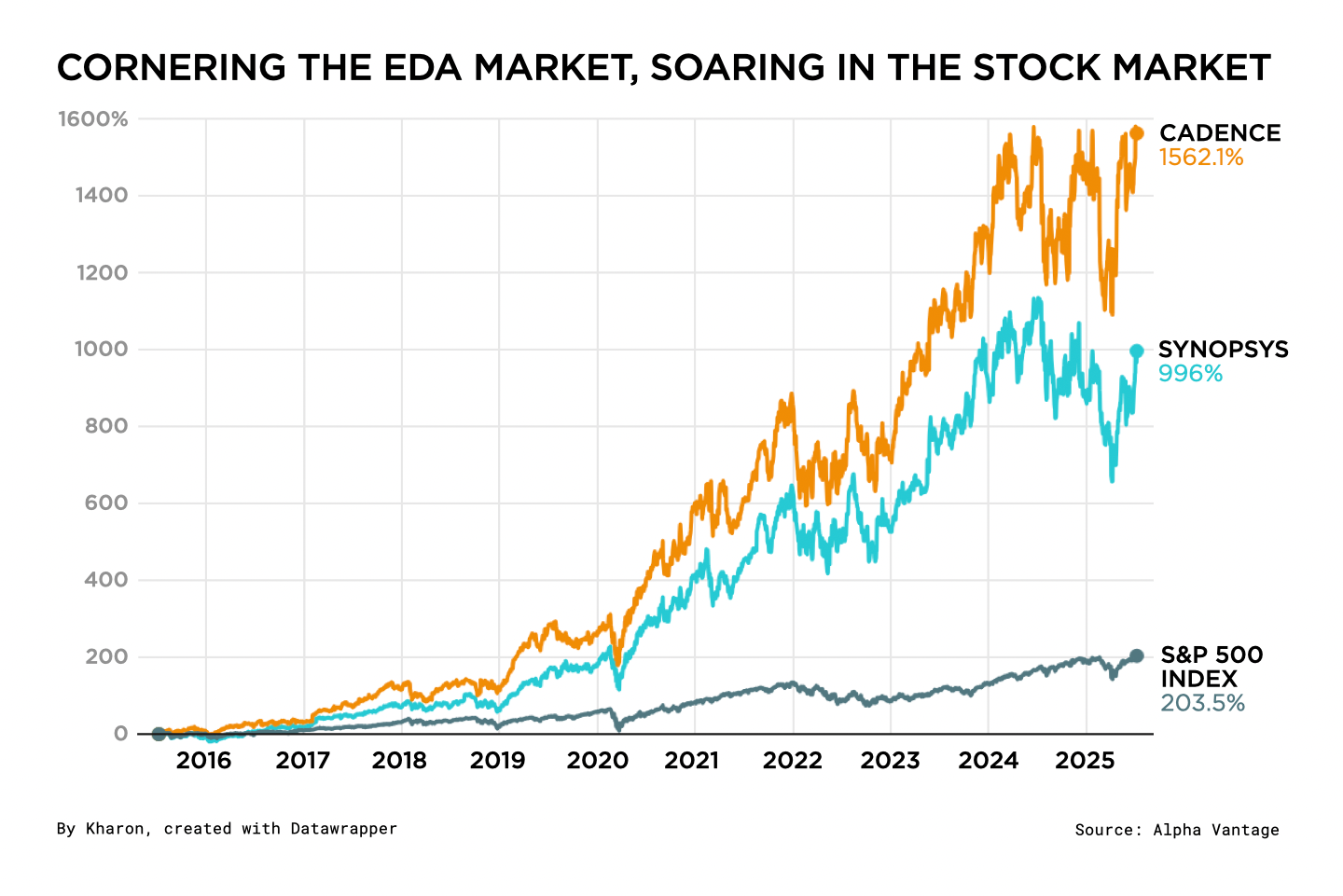

The ever-increasing complexity of integrated circuits has driven increases in employee headcount and demand for EDA software tools throughout the chip design process. This secular tailwind has driven the earnings of Cadence and Synopsys over the last 20 years.

Both companies’ shares fell sharply in response to the May move by the Trump administration, even though it came with few details. In hindsight, that lack of regulatory clarity looks to have been a signal that the administration’s move was tactical, not permanent.

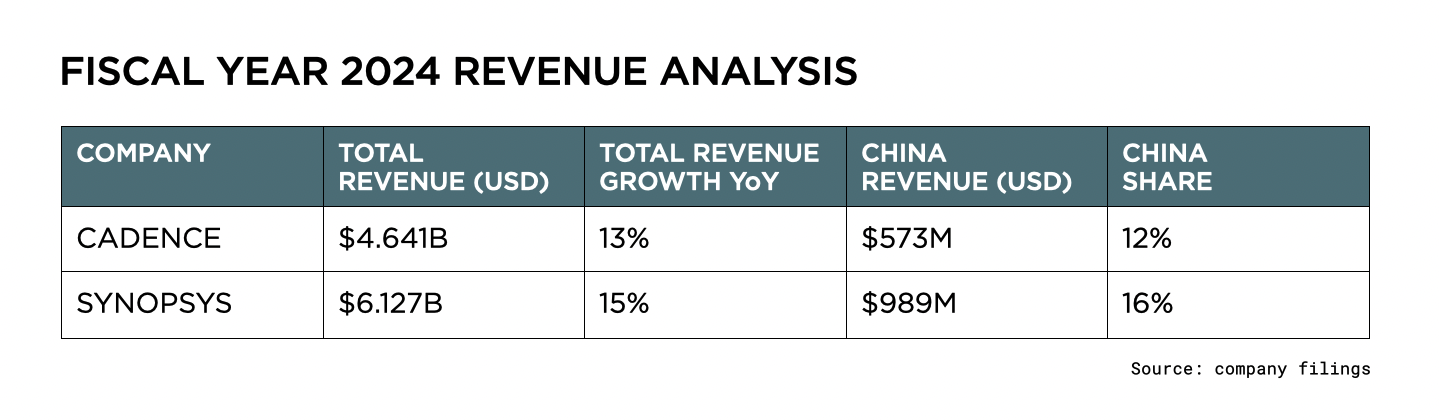

Synopsys and Cadence: These firms are cornerstones in the semiconductor supply chain. Their combined annual revenue exceeds $10 billion, in a market estimated to be worth around $15 billion. They’re highly attractive by traditional investment metrics, too, like returns and capital efficiency.

Still, the decision provides an extra shot in the arm for the two companies, whose shares both rose Thursday. Synopsys CEO Sassine Ghazi said on an earnings call in late May that the company’s “deceleration” in China was poised to continue, owing in part to the “cumulative impact” of the export restrictions.

But both EDA makers were growing at sizable clips nonetheless. The rollback isn’t likely to alter either’s long-term growth story.

Synopsys and Cadence: These firms are cornerstones in the semiconductor supply chain. Their combined annual revenue exceeds $10 billion, in a market estimated to be worth around $15 billion. They’re highly attractive by traditional investment metrics, too, like returns and capital efficiency.

Still, the decision provides an extra shot in the arm for the two companies, whose shares both rose Thursday. Synopsys CEO Sassine Ghazi said on an earnings call in late May that the company’s “deceleration” in China was poised to continue, owing in part to the “cumulative impact” of the export restrictions.

But both EDA makers were growing at sizable clips nonetheless. The rollback isn’t likely to alter either’s long-term growth story.

China impacts: The more decisive long-term winners look to be Chinese chip companies—and those that could benefit from their chips downstream. Domestic EDA alternatives, such as Empyrean, haven’t been able to match the output of Synopsys and Cadence; some Chinese start-ups have turned to using localized versions of hacked U.S. software.

“I have not in my decade in China met a chip design company that isn’t using either Synopsys or Cadence,” Stewart Randall, a Shanghai-based consultant and EDA salesman to top Chinese chipmakers, told the Washington Post in 2021. Now, their access is freed up again.

Companies like GigaDevice Semiconductor [SHA:603986], a Chinese leader in semiconductor design, could benefit. In a June 2025 filing, GigaDevice called out the proposed China EDA ban, alluding to “reduced access to key software, which could negatively impact our design capabilities.” That roadblock has now been cleared.

What we’re watching: The unique market position of U.S. EDA firms could still attract regulatory action for them and their partners in China. Particularly the riskier ones.

As the Brief reported back in 2021, buyers of U.S.-origin EDA tech have included a branch of the People’s Liberation Army; the weapons-maker China North Industries Group (NORINCO), which the U.S. Treasury Department has named to a list of Chinese military companies; and military-tied academic and research institutions, including some subject to export controls over diversion concerns. Such buyers have acquired EDA technology through approved partners of the U.S. companies or through shell companies.

One Cadence and Synopsys partner with notable risk exposure is VeriSilicon Shanghai [SHA: 688521], a listed entity on the Shanghai Stock Exchange that offers custom silicon design and IP licensing. It has a market capitalization equivalent to around $6 billion USD.

VeriSilicon touted in a news release last year that its IP had been integrated into more than 100 million AI chips worldwide. Since its 2020 prospectus, the company has offered limited visibility into its customer base. However, the disclosed list at that time included several Chinese customers subject to export controls, as well as three other high-risk counterparties:

Read more on investment:

“I have not in my decade in China met a chip design company that isn’t using either Synopsys or Cadence,” Stewart Randall, a Shanghai-based consultant and EDA salesman to top Chinese chipmakers, told the Washington Post in 2021. Now, their access is freed up again.

Companies like GigaDevice Semiconductor [SHA:603986], a Chinese leader in semiconductor design, could benefit. In a June 2025 filing, GigaDevice called out the proposed China EDA ban, alluding to “reduced access to key software, which could negatively impact our design capabilities.” That roadblock has now been cleared.

What we’re watching: The unique market position of U.S. EDA firms could still attract regulatory action for them and their partners in China. Particularly the riskier ones.

As the Brief reported back in 2021, buyers of U.S.-origin EDA tech have included a branch of the People’s Liberation Army; the weapons-maker China North Industries Group (NORINCO), which the U.S. Treasury Department has named to a list of Chinese military companies; and military-tied academic and research institutions, including some subject to export controls over diversion concerns. Such buyers have acquired EDA technology through approved partners of the U.S. companies or through shell companies.

One Cadence and Synopsys partner with notable risk exposure is VeriSilicon Shanghai [SHA: 688521], a listed entity on the Shanghai Stock Exchange that offers custom silicon design and IP licensing. It has a market capitalization equivalent to around $6 billion USD.

VeriSilicon touted in a news release last year that its IP had been integrated into more than 100 million AI chips worldwide. Since its 2020 prospectus, the company has offered limited visibility into its customer base. However, the disclosed list at that time included several Chinese customers subject to export controls, as well as three other high-risk counterparties:

- Huawei Technologies, which the U.S. added to the U.S. Entity list in 2019, for involvement in “activities contrary to the national security or foreign policy interests of the United States.” The U.S. also added Huawei to its Chinese Military-Industrial Complex Companies List in 2021.

- ZTE Corporation, the state-linked telecommunications giant, which was formerly on the Entity List itself. The Federal Communications Commission in 2020 labeled ZTE, along with Huawei, as a national security threat, citing their “close ties to the Chinese Communist Party and China’s military apparatus” and Chinese law “obligating them to cooperate with the country’s intelligence services.”

- Zhejiang Dahua Technology has been on the Entity List since 2019. The Commerce Department said it was “implicated in human rights violations and abuses in the implementation of China's campaign of repression, mass arbitrary detention, and high-technology surveillance against Uighurs, Kazakhs, and other members of Muslim minority groups” in the Xinjiang Autonomous Region.

Read more on investment: