The U.S. last week unleashed its largest Iran-related sanctions action since 2018, targeting more than 115 vessels, entities and individuals in a network that moved billions of dollars in Iranian and Russian oil products while evading international restrictions. It’s a cross-continental web that Kharon identified and mapped starting last year.

The Treasury Department’s action most prominently targeted the businessman who directs the shipping network, Mohammad Hossein Shamkhani, son of a top adviser to Iran’s Supreme Leader. Operating under aliases, Treasury said, the younger Shamkhani controls “a significant portion of Iran’s crude oil exports” through a maze of shell companies.

His father, Ali Shamkhani, survived an Israeli assassination attempt last month. Treasury said the son leveraged his father’s political influence to build a massive fleet while operating a hedge fund from Switzerland, the UAE and Singapore to manage profits.

“The Shamkhani family’s shipping empire highlights how Iranian regime elites leverage their positions to accrue massive wealth,” Treasury Secretary Scott Bessent said in a news release announcing the designations.

The Treasury Department’s action most prominently targeted the businessman who directs the shipping network, Mohammad Hossein Shamkhani, son of a top adviser to Iran’s Supreme Leader. Operating under aliases, Treasury said, the younger Shamkhani controls “a significant portion of Iran’s crude oil exports” through a maze of shell companies.

His father, Ali Shamkhani, survived an Israeli assassination attempt last month. Treasury said the son leveraged his father’s political influence to build a massive fleet while operating a hedge fund from Switzerland, the UAE and Singapore to manage profits.

“The Shamkhani family’s shipping empire highlights how Iranian regime elites leverage their positions to accrue massive wealth,” Treasury Secretary Scott Bessent said in a news release announcing the designations.

That empire underscores how Iran’s big-money oil and gas industry has persisted in an era of renewed maximum pressure—by consolidating, by obfuscating and by continuing, as a result, to reach buyers worldwide.

Additional profits flow through hedge funds and money-laundering operations.

Admiral Group is a Dubai-based shipping company founded in 2011 and run by Mohammad Hossein Shamkhani and his brother Hassan. Its name is an apparent reference to their father, a rear admiral in the Islamic Revolutionary Guard Corps Navy.

While Admiral Group was not targeted in the U.S. sanctions action, the European Union designated it last month under the bloc’s latest Russia sanctions, stating that Shamkhani “uses the company to transport and sell Russian crude oil.” A Bloomberg report from December cast Admiral Group as the network’s means of funneling sanctioned oil revenues into the Western system through shell companies, real estate and hedge funds.

Using LinkedIn profiles and other social media accounts tied to Admiral Group, Kharon research found that a company named ADM Logistics Group acts as its Iranian branch. ADM Logistics, in turn, controls additional companies in Iran, some of which have partnered with Russian and Chinese shipping and logistics firms.

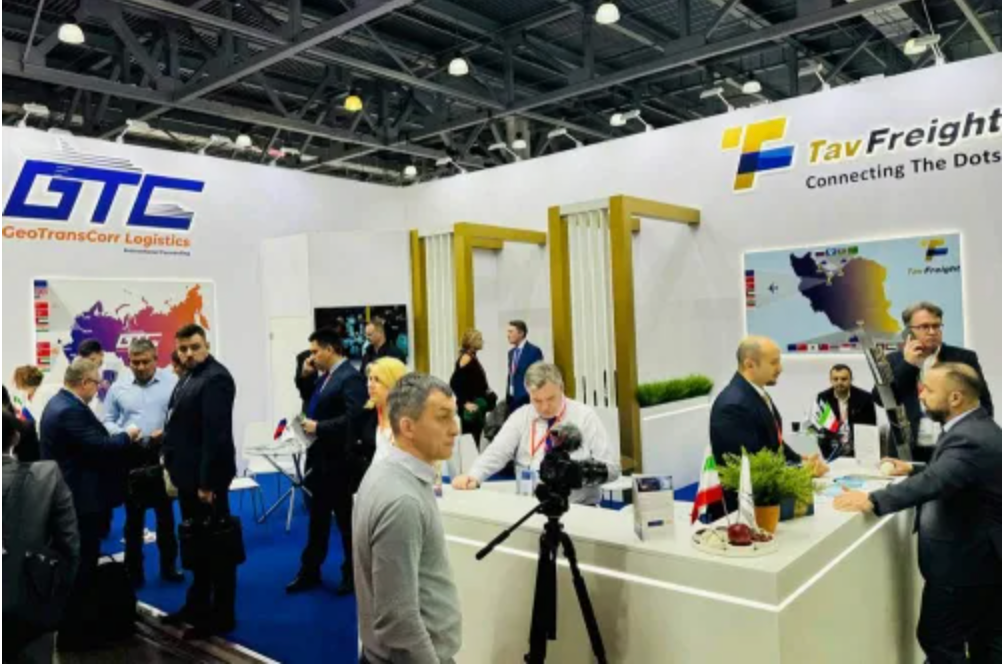

Russian connection: One of those subsidiaries is Tav Freight, an Iranian transportation firm. Tav Freight partners closely with the Russian company GTC Logistics, so closely that the two companies shared exhibition-booth space in Moscow at TransRussia 2024, Eurasia’s largest logistics and transportation trade show.

How it operates

The Shamkhani network, Treasury said, uses front companies to buy Iranian and Russian oil; falsifies shipping documents; leverages its shipping company to shuffle vessel operators frequently, obscuring the Shamkhanis’ role; and sells the oil to buyers who pay via front companies to obscure their own.Additional profits flow through hedge funds and money-laundering operations.

Three anchors of the network

1. THE STRING-PULLERAdmiral Group is a Dubai-based shipping company founded in 2011 and run by Mohammad Hossein Shamkhani and his brother Hassan. Its name is an apparent reference to their father, a rear admiral in the Islamic Revolutionary Guard Corps Navy.

While Admiral Group was not targeted in the U.S. sanctions action, the European Union designated it last month under the bloc’s latest Russia sanctions, stating that Shamkhani “uses the company to transport and sell Russian crude oil.” A Bloomberg report from December cast Admiral Group as the network’s means of funneling sanctioned oil revenues into the Western system through shell companies, real estate and hedge funds.

Using LinkedIn profiles and other social media accounts tied to Admiral Group, Kharon research found that a company named ADM Logistics Group acts as its Iranian branch. ADM Logistics, in turn, controls additional companies in Iran, some of which have partnered with Russian and Chinese shipping and logistics firms.

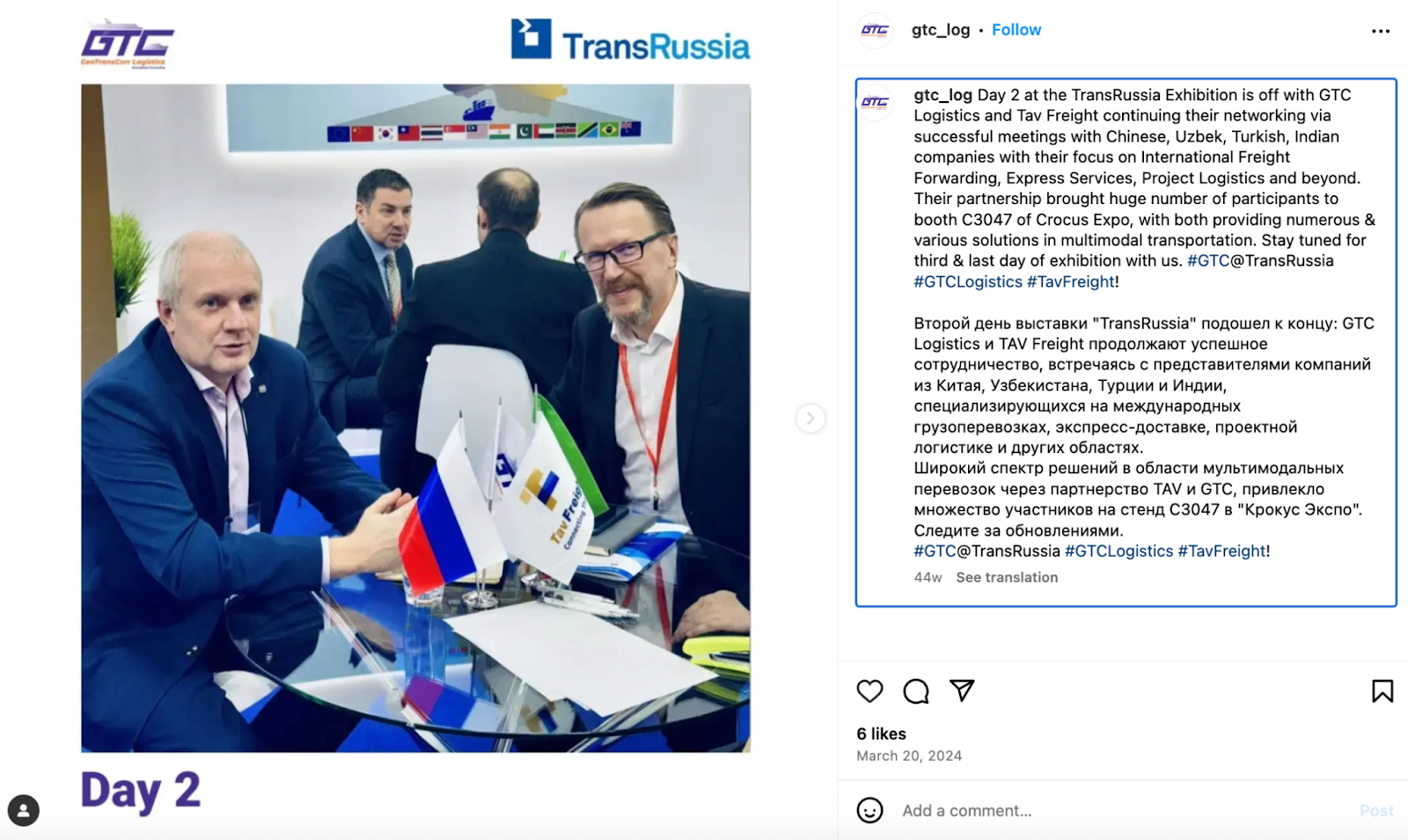

Russian connection: One of those subsidiaries is Tav Freight, an Iranian transportation firm. Tav Freight partners closely with the Russian company GTC Logistics, so closely that the two companies shared exhibition-booth space in Moscow at TransRussia 2024, Eurasia’s largest logistics and transportation trade show.

According to a website for GTC Logistics, “Having combined their expertise in logistics’ supply chain, freight forwarding, multimodal transportation, and express solutions, the two companies have presented a united front that resonates with both existing & potential clients.”

As you’ll see below, Russia-based GTC Logistics connects to more Admiral Group-tied companies, too.

Russian company GTC Logistics and Iranian Shamkhani subsidiary Tav Freight shared a booth at TransRussia 2024. (GTC Logistics)

GTC Logistics and Tav Freight post about their exhibition team-up. (Instagram)

Chinese connection: Espad Darya Paya, another ADM Logistics subsidiary, has sponsored a number of petroleum products conferences in China, Thailand and the UAE, including the 2024 China Bitumen and Road Conference.

Espad Darya Paya appears to maintain business ties with a Chinese shipping company called Vuxx Shipping (Shanghai) Ltd., a fellow sponsor of that conference. According to a February 2023 civil ruling from the Shanghai High People's Court, the two companies were co-defendants in a maritime cargo transportation contract dispute.

From here, vessels and shared identifiers stitch the network more completely together. According to maritime reporting, Vuxx Shipping has deployed three ships connected to Shamkhani’s network in its new service connecting South America to Russia. Vuxx also shares a phone number and shipping agent with GTC Logistics’ UAE branch, suggesting a relationship there, too.

Espad Darya Paya appears to maintain business ties with a Chinese shipping company called Vuxx Shipping (Shanghai) Ltd., a fellow sponsor of that conference. According to a February 2023 civil ruling from the Shanghai High People's Court, the two companies were co-defendants in a maritime cargo transportation contract dispute.

From here, vessels and shared identifiers stitch the network more completely together. According to maritime reporting, Vuxx Shipping has deployed three ships connected to Shamkhani’s network in its new service connecting South America to Russia. Vuxx also shares a phone number and shipping agent with GTC Logistics’ UAE branch, suggesting a relationship there, too.

Taken together, the ADM Logistics subsidiaries entwine Shamkhani’s Iranian oil-shipping empire with Chinese, Russian and UAE business, all at once.

2. THE SHIPPING OPERATOR

Last week’s sanctions targeted 62 vessels, mostly oil tankers and container ships, in Mohammad Hossein Shamkhani’s network. Crios Shipping LLC is one of its maritime cornerstones, operating a “shadow fleet” of tankers that transported Iranian and Russian oil to buyers worldwide while evading detection, Treasury said.

Treasury also linked Crios to a weapons-for-oil scheme in which Iran shipped missiles and drone components to Russia in exchange for petroleum that Shamkhani's network then resold globally.

Besides sanctioning Crios itself, the U.S. designated at least three vessels previously operated by Crios, Kharon research shows. Over recent months, according to maritime records, portions of Crios’s fleet were transferred to Vizoro Shipping FZE, a UAE-based entity that was not named in last week’s sanctions rollout.

2. THE SHIPPING OPERATOR

Last week’s sanctions targeted 62 vessels, mostly oil tankers and container ships, in Mohammad Hossein Shamkhani’s network. Crios Shipping LLC is one of its maritime cornerstones, operating a “shadow fleet” of tankers that transported Iranian and Russian oil to buyers worldwide while evading detection, Treasury said.

Treasury also linked Crios to a weapons-for-oil scheme in which Iran shipped missiles and drone components to Russia in exchange for petroleum that Shamkhani's network then resold globally.

Besides sanctioning Crios itself, the U.S. designated at least three vessels previously operated by Crios, Kharon research shows. Over recent months, according to maritime records, portions of Crios’s fleet were transferred to Vizoro Shipping FZE, a UAE-based entity that was not named in last week’s sanctions rollout.

The interconnected nature of the network is exemplified by the container ship DHANU. Previously operated by Crios, it’s owned by Neman Shipping Inc.—a Panamanian company that shares a phone number with UAE-based Crios, as Kharon research documented last year.

Treasury last week sanctioned Neman Shipping’s manager, the Panamanian national Hector Varela de Leon, for participating in Iran's petroleum economy and serving as an executive of what officials called “a likely front company” that facilitated financing of Iran’s Quds Force.

Treasury last week sanctioned Neman Shipping’s manager, the Panamanian national Hector Varela de Leon, for participating in Iran's petroleum economy and serving as an executive of what officials called “a likely front company” that facilitated financing of Iran’s Quds Force.

Varela de Leon manages an array of shipping and maritime companies registered in Panama. The U.S. previously had sanctioned four ships under him last year.

3. THE HEDGE FUND

Ocean Leonid Investments is a hedge fund that served as the vehicle for leveraging the Shamkhani network’s oil proceeds into investment profits, Treasury said in designating it. Bloomberg reported last October that Ocean Leonid was managing hundreds of millions of dollars on his behalf.

The hedge fund’s globe-crossing network is complex, and Treasury targeted several corners of it last week, including:

Ocean Leonid Investments is a hedge fund that served as the vehicle for leveraging the Shamkhani network’s oil proceeds into investment profits, Treasury said in designating it. Bloomberg reported last October that Ocean Leonid was managing hundreds of millions of dollars on his behalf.

The hedge fund’s globe-crossing network is complex, and Treasury targeted several corners of it last week, including:

- its Dubai-based parent company, Oenergy Commodities DMCC;

- its Swiss branch, Ocean Leonid Investments AG, established in 2021;

- Singapore entity Ocean Leonid Investments Singapore Pte Ltd, established the same year;

- and Shamkhani associate Yves Leon Agnes Demasure, Ocean Leonid’s former chief investment officer.

Luigi Spagna, an Italian national whom Treasury did not target with sanctions, manages a few of the Ocean Leonid companies. He also manages the UAE-based commodities trading and shipping firm Milavous Group Limited, which Treasury sanctioned for “assisting Hossein [Shamkhani] in arranging sales of Iranian oil and gas and laundering the proceeds.”

Ocean Leonid received capital directly from Shamkhani’s oil sales, according to Treasury’s release, with the Iranian tycoon personally involved in investment decisions “despite serving no official role in the business.”

The fund traded futures, options and securities—primarily in oil, gas and metals—using capital derived from Hossein's oil and gas sales. That led to “substantial profits” for Ocean Leonid between 2021 and 2024, Treasury said.

Yet Ocean Leonid’s London network—four firms sharing management with sanctioned affiliates—was not targeted by U.S. sanctions. U.K. records show that this British network, whose companies remain registered in the U.K.’s Companies House, is controlled by Dubai-based Isfad Fund LP, an entity that Treasury also did not sanction.

Ocean Leonid received capital directly from Shamkhani’s oil sales, according to Treasury’s release, with the Iranian tycoon personally involved in investment decisions “despite serving no official role in the business.”

The fund traded futures, options and securities—primarily in oil, gas and metals—using capital derived from Hossein's oil and gas sales. That led to “substantial profits” for Ocean Leonid between 2021 and 2024, Treasury said.

Yet Ocean Leonid’s London network—four firms sharing management with sanctioned affiliates—was not targeted by U.S. sanctions. U.K. records show that this British network, whose companies remain registered in the U.K.’s Companies House, is controlled by Dubai-based Isfad Fund LP, an entity that Treasury also did not sanction.

Last word

Treasury followed its sweeping Shamkhani rollout by designating additional parties the next day for supporting Iran’s drone program. Some were based in Iran, Hong Kong, China and Taiwan.It reinforced the international nature of Iran’s procurement networks—and the U.S.’s commitment to keeping up the pressure.

More from the Kharon Brief:

- By the Numbers: US ‘Maximum Pressure’ Reaches Far Beyond Iran’s Borders

- Inside an Intricate Shadow Fleet Crossing Russian, Iranian and Venezuelan Sanctions

- Two Iranian Shadow Fleet Firms Were Sanctioned. Their Directors Have a History.

- Navigating Risk in a Reopening Syria, Where Most (But Not All) Western Sanctions Are Gone