Updated: 26 August 2025

Ontermann LP is a London-based limited partnership that was established in 2020 by two Seychelles nationals. According to shipping records, it was involved in more than a year of wartime sales to Russia of goods on the Common High Priority List (CHPL), items that Moscow is believed to be seeking for military use.

But at Ontermann LP’s packed little second-floor address, such illicit shipments to Russia put it in good company.

Risk factors: Findings from Kharon’s investigation illustrate the opacity risks posed by certain corporate structures such as limited partnerships, which can conceal upstream ownership and related exposure. Such risks informed the U.K.’s recent reforms under the Economic Crime and Corporate Transparency Act of 2023, which impose stricter registration conditions and enhanced partner transparency requirements.

Ontermann LP is a London-based limited partnership that was established in 2020 by two Seychelles nationals. According to shipping records, it was involved in more than a year of wartime sales to Russia of goods on the Common High Priority List (CHPL), items that Moscow is believed to be seeking for military use.

But at Ontermann LP’s packed little second-floor address, such illicit shipments to Russia put it in good company.

Risk factors: Findings from Kharon’s investigation illustrate the opacity risks posed by certain corporate structures such as limited partnerships, which can conceal upstream ownership and related exposure. Such risks informed the U.K.’s recent reforms under the Economic Crime and Corporate Transparency Act of 2023, which impose stricter registration conditions and enhanced partner transparency requirements.

- According to a recent progress report, the U.K.’s Companies House has rejected 10,200 “suspicious applications” since implementing those LP reforms, “including where evidence has suggested mass incorporations at certain addresses are taking place.” That practice “has a known link with money laundering,” the U.K. said.

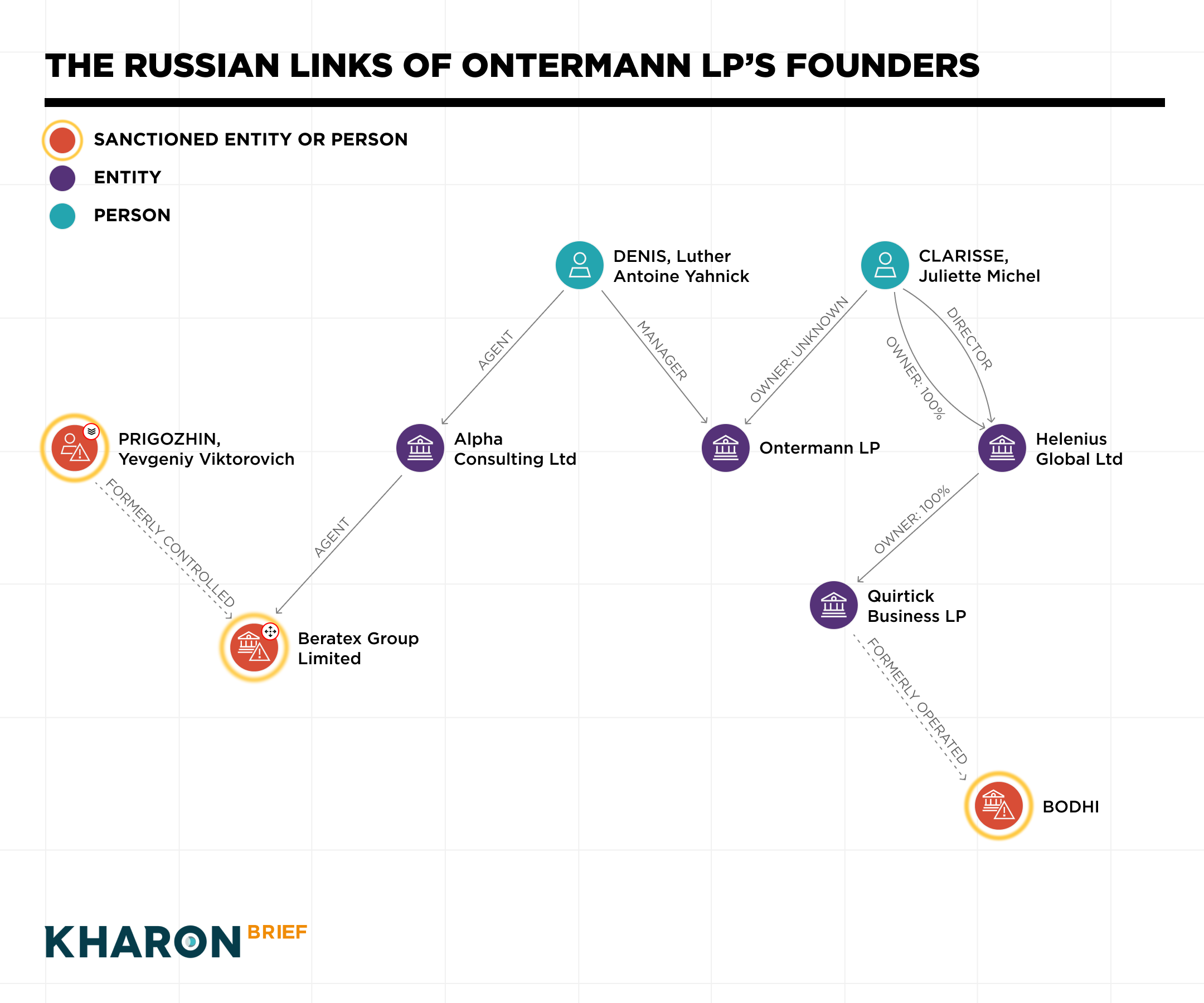

Background: The Seychelles nationals who founded Ontermann LP, Luther Denis and Juliette Clarisse, have established and, on paper, managed hundreds of companies, according to U.K. and international corporate records.

Media reporting has tied some of those companies, such as Alpha Consulting and Helenius Global Ltd, to facilitating Russia’s shadow fleet, money laundering and activities of high-profile Russians, such as the late Yevgeniy Prigozhin.

Media reporting has tied some of those companies, such as Alpha Consulting and Helenius Global Ltd, to facilitating Russia’s shadow fleet, money laundering and activities of high-profile Russians, such as the late Yevgeniy Prigozhin.

Kharon users can explore this Insight into Ontermann LP in greater detail through the ClearView platform.

The shipments: From December 2022 to March 2024, Ontermann LP sent nine shipments of Tier 1 CHPL goods to the Russian firm VR Snabzhenie OOO. The shipments included electronic integrated circuits and gas filtration devices by the U.S. manufacturers Honeywell, Analog Devices and Applied Analytics. (In a statement to the Brief after publication, Analog Devices said it had no records of a transaction with Ontermann LP, nor any customers at the 6 Market Place address.)

To facilitate several of those shipments, Ontermann LP used the Israeli company Liviatan Technologies Ltd, which was engaged in similar trade with the same Russian company. According to trade records, Liviatan independently sent VR Snabzhenie at least 4.7 million euros’ worth of Tier 1 and 3 CHPL goods, again including U.S.-made tech, between September 2022 and August 2023.

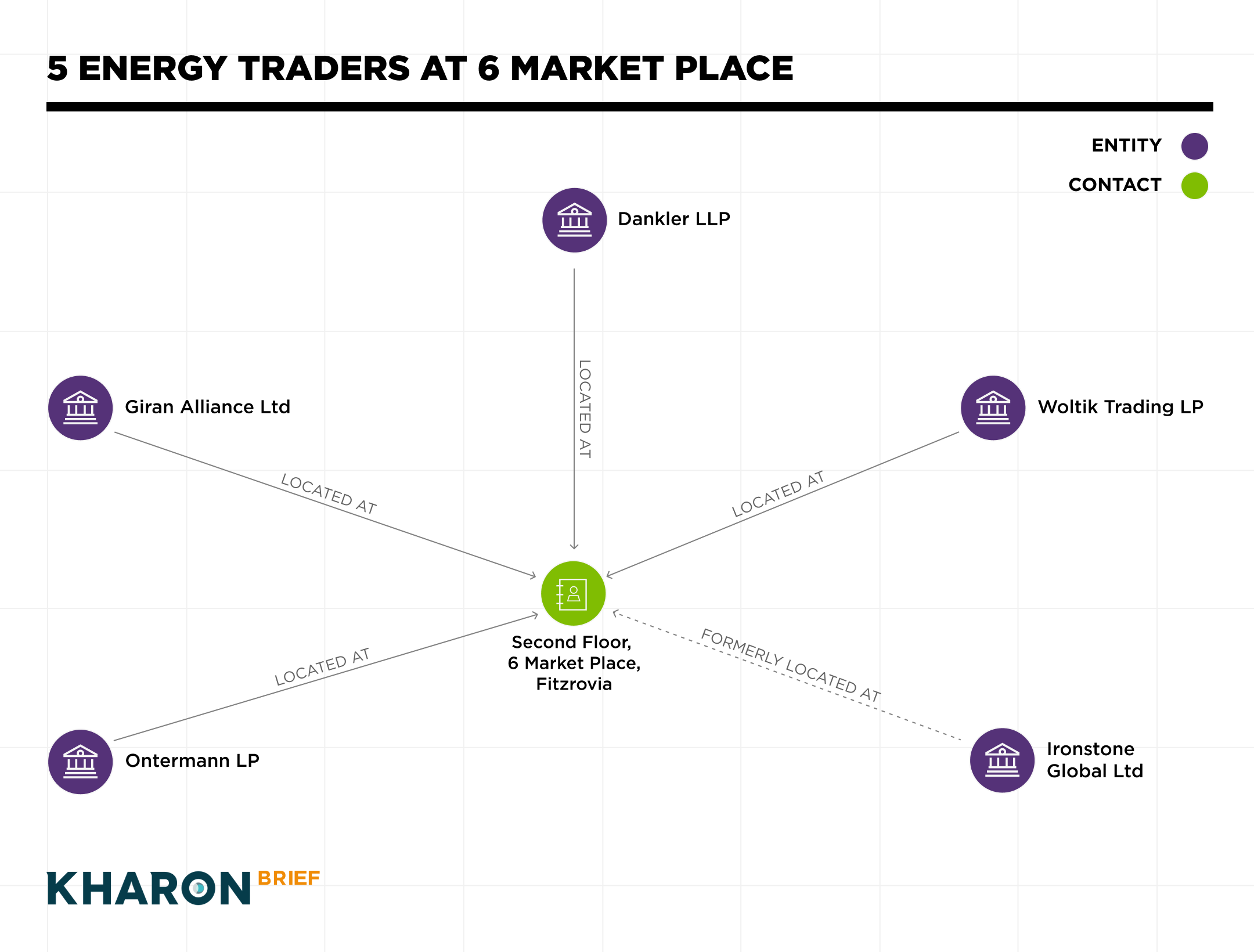

The Ontermann LP shipments to Russia all came while it was registered at a central-London address that it shared with hundreds of other firms: Second Floor, 6 Market Place, Fitzrovia.

Connecting the dots: The U.K.’s Companies House lists more than 170 active firms and more than 600 dissolved entities at that address, a small office space located above a Californian restaurant.

To facilitate several of those shipments, Ontermann LP used the Israeli company Liviatan Technologies Ltd, which was engaged in similar trade with the same Russian company. According to trade records, Liviatan independently sent VR Snabzhenie at least 4.7 million euros’ worth of Tier 1 and 3 CHPL goods, again including U.S.-made tech, between September 2022 and August 2023.

The Ontermann LP shipments to Russia all came while it was registered at a central-London address that it shared with hundreds of other firms: Second Floor, 6 Market Place, Fitzrovia.

Connecting the dots: The U.K.’s Companies House lists more than 170 active firms and more than 600 dissolved entities at that address, a small office space located above a Californian restaurant.

- Big picture: According to U.K. guidance, it’s a red flag for possible sanctions circumvention activity if a customer “shares their premises or registered address with multiple businesses or holding companies dealing in comparable goods.” That’s not “a definitive indicator,” the U.K. notes, but it “may suggest the use of multiple front companies to obfuscate illicit trade in sanctioned and controlled goods.”

Kharon users can explore this Insight into 6 Market Place in greater detail through the ClearView platform.

Companies registered there have included:

Identifying red-flag behaviors, such as clustering at mail-drop addresses or concealing beneficial ownership, remains critical for detecting and disrupting sanctions-evasion networks.

Freya Page contributed to this report.

Updated on 26 August 2025 with statement from Analog Devices.

More from the Kharon Brief:

- Woltik Trading LP, which, according to trade records, facilitated shipments between March and June 2023 of RUB 11,813,778 ($146,000 USD) worth of coal from a Russian mining company operating in occupied Ukraine. The U.K. has prohibited importing or facilitating the sale of Russian coal since 2022.

- Ironstone Global Ltd, which imported 44,000,000 kg of bituminous coal from Russia in October 2022. In December 2023, it also facilitated the shipment of 351,900 kg of Russian coal to a Hong Kong company on behalf of Edinburgh-based Laken Global LP. That Hong Kong company, Green Rabbit Limited, at the same time was active in importing shipments of coal from Russian firms operating in the occupied territories of Ukraine.

- Giran Alliance Ltd, a commodities trader that imported gas oils and heavy distillates from the sanctioned Russian giant Rosneft from June to September of 2023, after the U.K. and EU had implemented seaborne embargoes on such Russian products. Giran Alliance also imported at least RUB 694,306,832 ($8.5 million USD) worth of heavy distillates from another Russian company, Oyl Tekhnolodzhis OOO, between January and September 2023.

- Dankler LLP, a petrochemical trading firm that caters to clientele in the Former Soviet Union (FSU). Its domain shares a common registrant with several other FSU petrochemical traders, one of which has partnered with sanctioned Russian companies.

Identifying red-flag behaviors, such as clustering at mail-drop addresses or concealing beneficial ownership, remains critical for detecting and disrupting sanctions-evasion networks.

Freya Page contributed to this report.

Updated on 26 August 2025 with statement from Analog Devices.

More from the Kharon Brief: