Solar panels assembled by an Indian company whose supply chain has links to Xinjiang-origin polysilicon continue to flow into the U.S. market despite a 2021 ban prohibiting the importation of the raw material from the region.

In 2021, the U.S. government banned the import of polysilicon, a raw material used in solar panels, that originates from Xinjiang over concerns of widespread forced labor in the Chinese region.

The solar panel manufacturing chain is long and complex. It begins with polysilicon, which is melted into an ingot and then sliced into thin wafers that are used to make solar cells. These solar cells are then assembled into a solar panel.

Each step of the manufacturing process brings in different producers, often based in various countries, which can make it difficult to trace the supply chain of those materials.

China produces a significant amount of the world’s polysilicon, particularly in its Xinjiang region. According to the U.S. Department of Labor, “about 45% of the world’s polysilicon comes from Xinjiang, where it is regularly produced with forced labor.”

“China also produces more than 90% of the world’s ingots and wafers (made from polysilicon), some of which are used to produce solar cells and panels that are assembled in other countries,” the agency added.

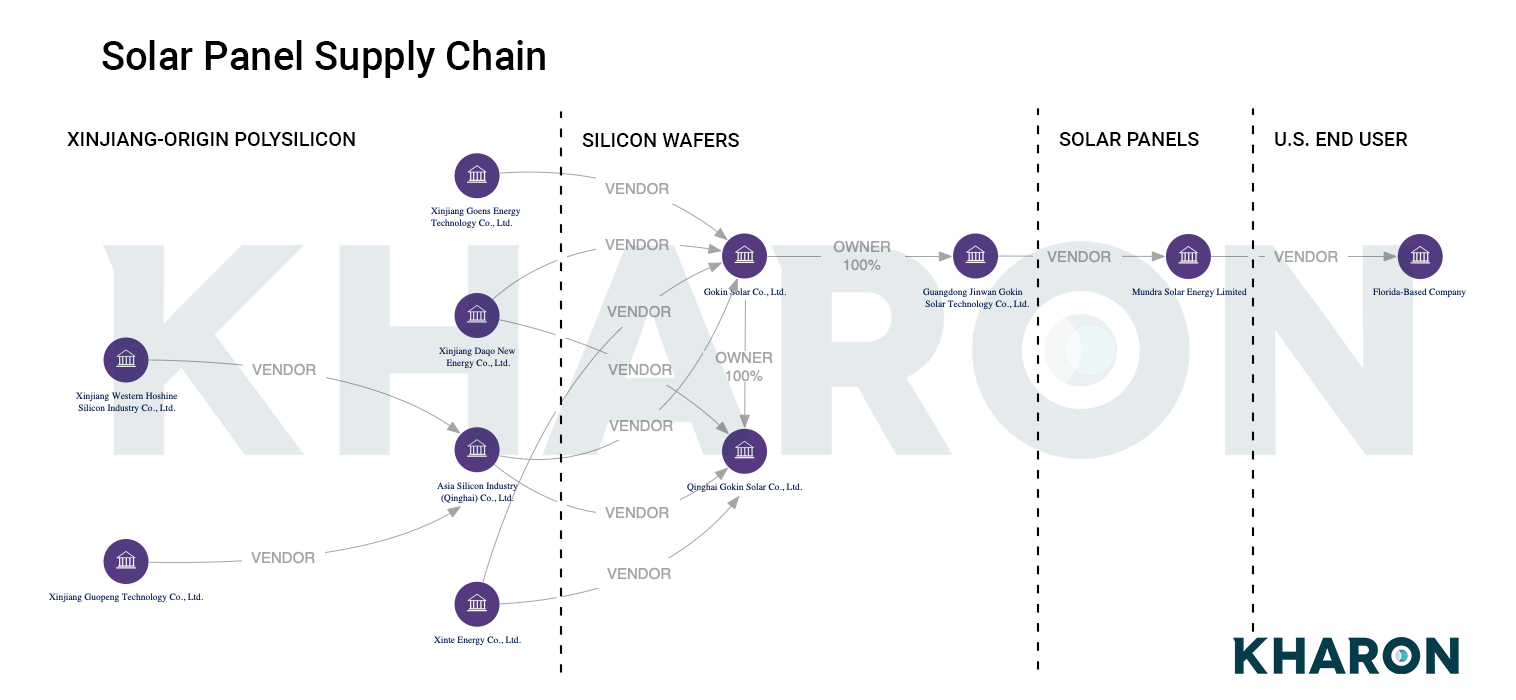

Kharon research shows that a key company in the solar panel supply chain procures polysilicon from Xinjiang-based companies, including some that have been added to the Uyghur Forced Labor Prevention Act (UFLPA) Entity List.

According to corporate disclosures, China-based silicon wafer maker Gokin Solar and one of its subsidiaries have ongoing contracts to procure hundreds of thousands of tons of polysilicon from companies based in Xinjiang, including Xinjiang Goens Energy (formerly Xinjiang GCL), Xinte Energy, and Xinjiang Daqo New Energy.

Additionally, Gokin Solar and its subsidiary procure polysilicon from Asia Silicon. Although Asia Silicon is not based in Xinjiang, it resells silicon materials mined by two Xinjiang-based companies: Xinjiang Western Hoshine Silicon Industry and Xinjiang Guopeng Technology, company documents show.

Xinjiang Goens Energy Technology, Xinjiang Daqo New Energy, and Xinjiang Western Hoshine Silicon were added to the UFLPA Entity List, which restricts the importation of any goods made by the listed entities into the U.S.

Between August 2023 and March 2024, one of Gokin Solar’s wholly-owned subsidiaries, Guangdong Jinwan Gokin Solar Technology, sold about $14 million worth of silicon wafers to an India-based company, Mundra Solar Energy Limited, which assembles solar panels.

As of April, Mundra Solar Energy’s solar panels have been shipped to a power utility company based in Florida that uses the materials for its solar power plants, according to trade records. It is not known if the panels imported to Florida contain any of the Xinjiang-origin polysilicon that Gokin purchased.

According to Bloomberg, India solar producers “exported almost $2 billion worth of panels to the US in the first 11 months of [2023], a fivefold increase over all of 2022.”

This is the latest in our ongoing investigations into the solar panel supply chain and its connections to forced labor in Xinjiang. Kharon previously reported on the imports of polysilicon from Xinjiang into the U.S.

In 2021, the U.S. government banned the import of polysilicon, a raw material used in solar panels, that originates from Xinjiang over concerns of widespread forced labor in the Chinese region.

The solar panel manufacturing chain is long and complex. It begins with polysilicon, which is melted into an ingot and then sliced into thin wafers that are used to make solar cells. These solar cells are then assembled into a solar panel.

Each step of the manufacturing process brings in different producers, often based in various countries, which can make it difficult to trace the supply chain of those materials.

China produces a significant amount of the world’s polysilicon, particularly in its Xinjiang region. According to the U.S. Department of Labor, “about 45% of the world’s polysilicon comes from Xinjiang, where it is regularly produced with forced labor.”

“China also produces more than 90% of the world’s ingots and wafers (made from polysilicon), some of which are used to produce solar cells and panels that are assembled in other countries,” the agency added.

Kharon research shows that a key company in the solar panel supply chain procures polysilicon from Xinjiang-based companies, including some that have been added to the Uyghur Forced Labor Prevention Act (UFLPA) Entity List.

According to corporate disclosures, China-based silicon wafer maker Gokin Solar and one of its subsidiaries have ongoing contracts to procure hundreds of thousands of tons of polysilicon from companies based in Xinjiang, including Xinjiang Goens Energy (formerly Xinjiang GCL), Xinte Energy, and Xinjiang Daqo New Energy.

Additionally, Gokin Solar and its subsidiary procure polysilicon from Asia Silicon. Although Asia Silicon is not based in Xinjiang, it resells silicon materials mined by two Xinjiang-based companies: Xinjiang Western Hoshine Silicon Industry and Xinjiang Guopeng Technology, company documents show.

Xinjiang Goens Energy Technology, Xinjiang Daqo New Energy, and Xinjiang Western Hoshine Silicon were added to the UFLPA Entity List, which restricts the importation of any goods made by the listed entities into the U.S.

Between August 2023 and March 2024, one of Gokin Solar’s wholly-owned subsidiaries, Guangdong Jinwan Gokin Solar Technology, sold about $14 million worth of silicon wafers to an India-based company, Mundra Solar Energy Limited, which assembles solar panels.

As of April, Mundra Solar Energy’s solar panels have been shipped to a power utility company based in Florida that uses the materials for its solar power plants, according to trade records. It is not known if the panels imported to Florida contain any of the Xinjiang-origin polysilicon that Gokin purchased.

According to Bloomberg, India solar producers “exported almost $2 billion worth of panels to the US in the first 11 months of [2023], a fivefold increase over all of 2022.”

This is the latest in our ongoing investigations into the solar panel supply chain and its connections to forced labor in Xinjiang. Kharon previously reported on the imports of polysilicon from Xinjiang into the U.S.

Kharon users can explore the solar panel supply chain in ClearView. Click here to view.