In April, China’s military released a propaganda video titled “The Robot Dog’s Time to Kill Has Come.” It opened like a science-fiction thriller.

A four-legged robot scurries across the training ground, with an automatic rifle mounted on its back. Soldiers in fatigues run alongside the mechanical dog as it fires at a target, striking it down with precision. Then, a close-up of the robot shows the logo of Unitree Robotics’ “Go2” model, which the company markets on its website as “a new creature of embodied AI.”

The footage marked the most explicit demonstration to date of how Unitree, a Chinese company that publicly emphasizes civilian applications, has become entangled in the country’s military ambitions. A Kharon investigation found that Unitree’s ties to China’s defense ecosystem appear to run far deeper than previously understood.

A four-legged robot scurries across the training ground, with an automatic rifle mounted on its back. Soldiers in fatigues run alongside the mechanical dog as it fires at a target, striking it down with precision. Then, a close-up of the robot shows the logo of Unitree Robotics’ “Go2” model, which the company markets on its website as “a new creature of embodied AI.”

The footage marked the most explicit demonstration to date of how Unitree, a Chinese company that publicly emphasizes civilian applications, has become entangled in the country’s military ambitions. A Kharon investigation found that Unitree’s ties to China’s defense ecosystem appear to run far deeper than previously understood.

For almost a decade now, Unitree has built its business and its reputation on more affordable alternatives to Boston Dynamics’ famous robot dogs, pricing its own quadruped robots at less than $3,000, compared to Spot’s $75,000 price tag. Unitree has consistently positioned itself against robots’ military applications, developing them instead for logistics, rescue operations and even household use.

But Chinese procurement records, official documents and corporate filings show that Unitree has sold its technology to universities with track records of providing equipment to People’s Liberation Army (PLA) units, and has partnered with major Chinese technology firms under U.S. restrictions. The developments reflect Beijing’s push to merge civilian innovation with military power, a core priority in President Xi Jinping’s vision of building “a world-class military.”

China sees robotics as critical to the next era of artificial intelligence—and an area where it could surpass the U.S., said Austin Wang, an associate political scientist at the RAND Corporation who studies emerging technologies in geopolitics. The inclusion of company logos in PLA footage “shows the private sector is ahead [of the military] in R&D and central to China’s military-civil fusion strategy,” he said.

Unitree did not respond to an emailed list of questions sent by the Brief, including about its robots’ use in Chinese military training exercises, any agreements it may have with the PLA and its sales to military-linked universities.

Despite the dramatic imagery, analysts say robotic dogs like Unitree’s likely have limited battlefield use for now. But China appears to be betting they’ll be a part of the battlefield future. YingYu Lin, a professor at Taiwan’s Tamkang University and an expert on the PLA, said that while unmanned systems are already widely used in modern warfare, “the next phase is AI integration—simply put, putting the brain on the robot.”

But Chinese procurement records, official documents and corporate filings show that Unitree has sold its technology to universities with track records of providing equipment to People’s Liberation Army (PLA) units, and has partnered with major Chinese technology firms under U.S. restrictions. The developments reflect Beijing’s push to merge civilian innovation with military power, a core priority in President Xi Jinping’s vision of building “a world-class military.”

China sees robotics as critical to the next era of artificial intelligence—and an area where it could surpass the U.S., said Austin Wang, an associate political scientist at the RAND Corporation who studies emerging technologies in geopolitics. The inclusion of company logos in PLA footage “shows the private sector is ahead [of the military] in R&D and central to China’s military-civil fusion strategy,” he said.

Unitree did not respond to an emailed list of questions sent by the Brief, including about its robots’ use in Chinese military training exercises, any agreements it may have with the PLA and its sales to military-linked universities.

Despite the dramatic imagery, analysts say robotic dogs like Unitree’s likely have limited battlefield use for now. But China appears to be betting they’ll be a part of the battlefield future. YingYu Lin, a professor at Taiwan’s Tamkang University and an expert on the PLA, said that while unmanned systems are already widely used in modern warfare, “the next phase is AI integration—simply put, putting the brain on the robot.”

A Pledge Against Weaponization

Wang Xingxing, who studied mechanical engineering at Shanghai University, founded Unitree in 2016, the same year that Boston Dynamics unveiled its humanoid robot Atlas and the quadruped that would become Spot. Wang saw an opportunity to compete, he said, by focusing on speed and affordability.“Boston Dynamics’ robot dogs are undeniably more capable than ours in terms of functionality, but it is not our direct competitor,” he said in a 2021 interview. “It took them five years to make Spot available for purchase, while we have released at least one or two products every year since our launch. We have a much faster product cycle.”

Despite that competition, Unitree and Boston Dynamics found common ground on a fundamental principle: keeping their robots out of warfare. In 2022, they joined four other robotics firms in signing an open letter pledging “not to weaponize our robots or enable others to do so.”

“When possible, we will carefully review our customers’ intended applications to avoid potential weaponization,” the group wrote. It urged the industry to follow suit.

But in China that kind of public stance is increasingly difficult. In March, Beijing introduced new rules restricting what can be said or published about the military. Now, “even if Unitree knows more about the details” of the PLA’s use of its robots, Austin Wang said, “they cannot disclose them without breaking the law.”

In any case, two years after Unitree signed the pledge, state-owned CCTV posted a May 2024 video depicting Unitree’s B1 quadruped robots in joint military exercises between China and Cambodia, working alongside armed quadcopters and human soldiers during urban assault simulations. “It can serve as a new member in our urban combat operations, replacing humans in reconnaissance and target strikes,” a Chinese soldier told CCTV.

In April, the Unitree robot model was prominently featured in a military context again, in the PLA propaganda video. “I think the video highlights a moment of mutual understanding between both sides,” Lin said. And that understanding, he said, could pave the way for future procurement deals.

Unitree has certainly benefited from state support to date, including emergency funding that “brought it back to life” when it faced possible collapse in 2017, according to a government document reviewed by Kharon. Hangzhou heavily subsidizes the company through its $14 billion Sci-Tech Fund and through its designation of Unitree as one of the city’s “six little dragons,” a group that also includes the AI upstart DeepSeek.

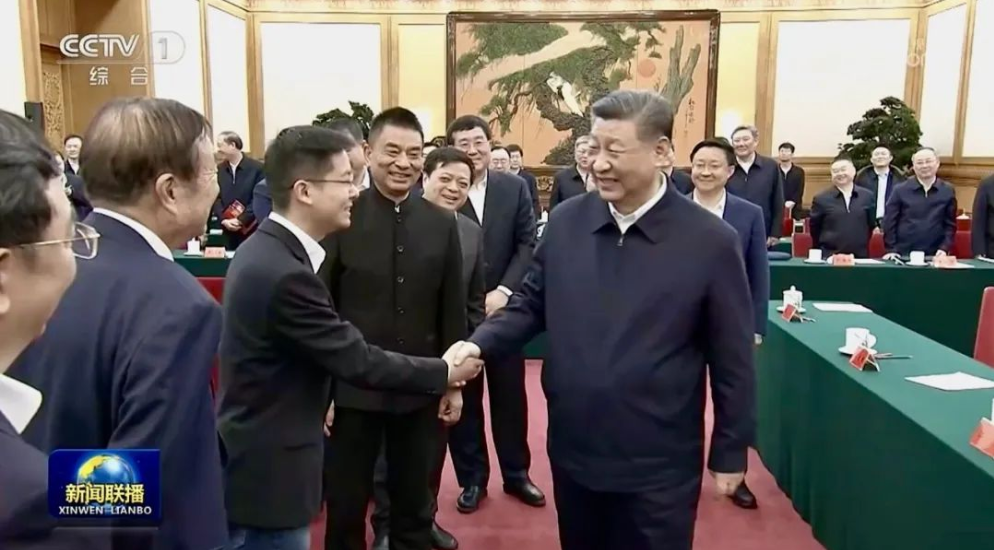

In February, Chinese President Xi Jinping invited six entrepreneurs to speak at a rare closed-door meeting. Among them were the founder and chief executive of the telecoms titan Huawei, the leader of electric-vehicle giant BYD, and Wang Xingxing.

Unitree has certainly benefited from state support to date, including emergency funding that “brought it back to life” when it faced possible collapse in 2017, according to a government document reviewed by Kharon. Hangzhou heavily subsidizes the company through its $14 billion Sci-Tech Fund and through its designation of Unitree as one of the city’s “six little dragons,” a group that also includes the AI upstart DeepSeek.

In February, Chinese President Xi Jinping invited six entrepreneurs to speak at a rare closed-door meeting. Among them were the founder and chief executive of the telecoms titan Huawei, the leader of electric-vehicle giant BYD, and Wang Xingxing.

Unitree founder and CEO Wang Xingxing shakes hands with Xi Jinping at a meeting in February 2025, with Huawei’s CEO standing nearby. (CCTV footage)

Sales to State ‘R&D Hubs’

Unitree has said it does not sell its products to China’s military, and it remains unclear how the PLA acquired the robot dogs featured in its live training exercises. But procurement records offer possible clues.Chinese university sales make up a significant share of Unitree’s domestic business, with nearly 30 institutions buying Unitree products over the past five years, according to the Chinese news outlet WallStreetCN. Many of these institutions, Kharon found, have long-running ties to China’s military establishment and have played key roles in advancing military technologies under the banner of civilian research.

“Universities are not typically involved in direct military production but rather serve as R&D hubs,” explained Tai Ming Cheung, a professor of global policy at UC San Diego and the author of “Innovate to Dominate: The Rise of the Chinese Techno-Security State.”

A 2017 directive from China’s National Administration of State Secrets Protection said that military-civil fusion would bring universities more "classified projects" as integration deepened. Beijing now is pushing, Cheung said, to “improve the industrialization or the commercialization of the R&D side of defense universities” to accelerate military modernization and prepare for potential wars, top national priorities for Xi.

Unitree’s own integration is playing out in real time. A July 2 online post by Chongqing Vocational College of Intelligent Engineering, a school jointly established by the local government and Huawei, showed a military training exercise that featured two weaponized Unitree dogs. One was equipped with a rifle; another launched a rocket across an athletic field, igniting a target in a burst of flames and drawing cheers. State media reported that the demonstration was developed jointly by students, faculty and a military training team.

Unitree robots, one mounted with a rifle and the other with a rocket launcher, participate in a military training exercise earlier this month. (Chongqing Vocational College of Intelligent Engineering)

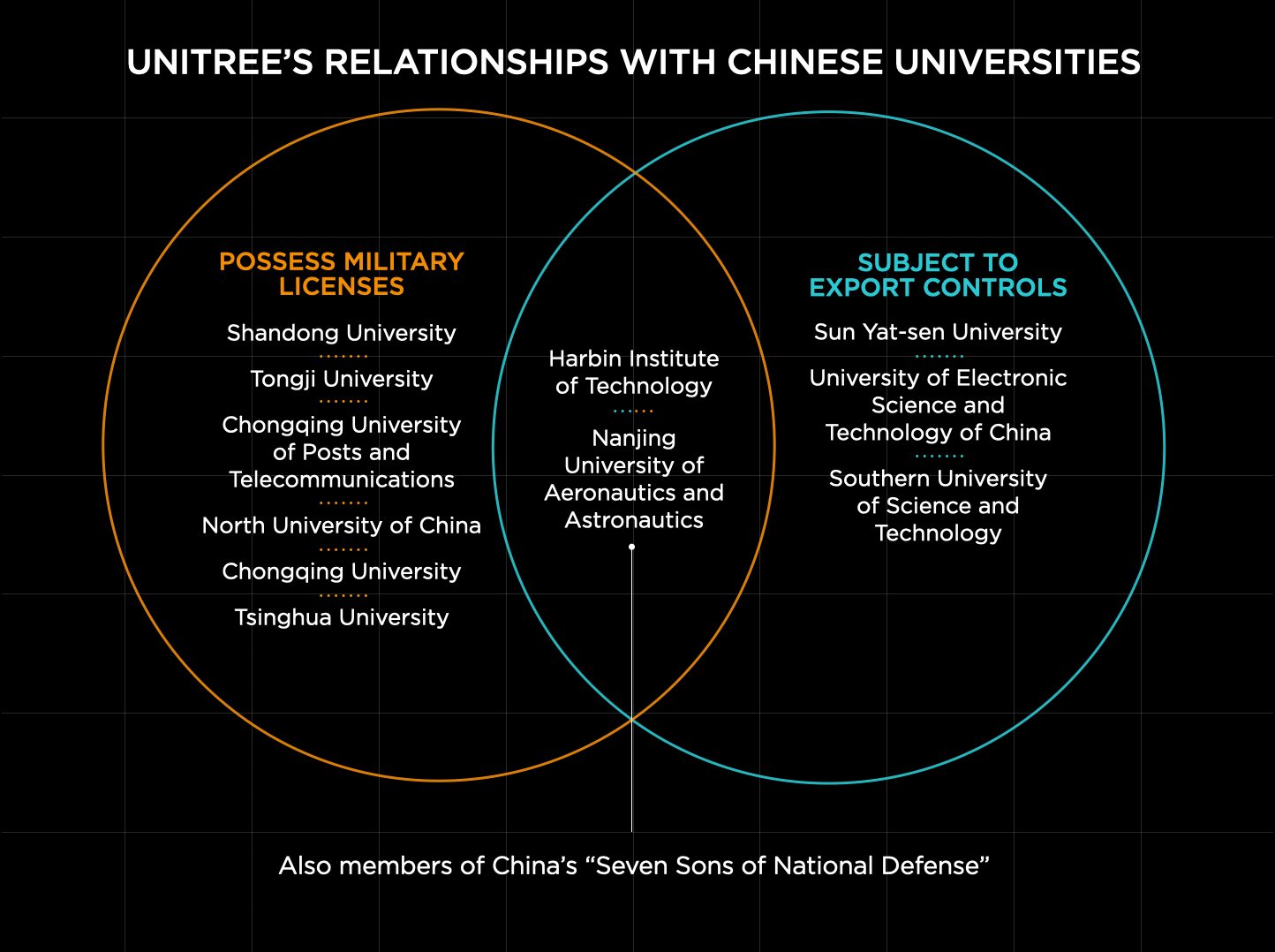

Kharon’s examination of procurement data from 2018 through May found that at least eight Unitree university customers hold government or military licenses for classified defense research and manufacturing. At least five are on U.S. or Canadian export control lists for links to activities deemed national security threats. Unitree itself faces no such restrictions.

Among its customers are Harbin Institute of Technology and Nanjing University of Aeronautics, two of China’s “Seven Sons of National Defense,” universities that Beijing has designated as key feeders for the military and defense industry. The U.S. placed Harbin Institute of Technology on its Entity List in 2020 for seeking “to use U.S. technology for Chinese missile programs”; it added Nanjing University of Aeronautics soon after, for “acquiring and attempting to acquire U.S.-origin items in support of programs for the People's Liberation Army.”

Among its customers are Harbin Institute of Technology and Nanjing University of Aeronautics, two of China’s “Seven Sons of National Defense,” universities that Beijing has designated as key feeders for the military and defense industry. The U.S. placed Harbin Institute of Technology on its Entity List in 2020 for seeking “to use U.S. technology for Chinese missile programs”; it added Nanjing University of Aeronautics soon after, for “acquiring and attempting to acquire U.S.-origin items in support of programs for the People's Liberation Army.”

Another Unitree customer, according to procurement records, is North University of China, known as the “First School for People’s Ordnance” for its role in PLA weapons research. The university stated in December 2022 documents that its Unitree purchase was for “weapon science and technology” applications.

A more recent transaction of note occurred in March, when Tongji University—an institution with a record of bidding for PLA contracts—purchased $1.15 million worth of Unitree products, including 10 of its general-purpose humanoid robots. A local outlet described the deal, which it said followed Tongji’s purchase of $145,000 worth of Unitree quadruped robots in 2021, as “the largest single order by any university, both in volume and value.” Tongji said the purchase was for research and student training.

“The PLA benefits from these universities’ access to foreign technology through academic partnerships and procurement channels that appear benign,” said Sunny Cheung, a China studies fellow at the Jamestown Foundation. China still relies on overseas suppliers for key robotics components, including AI chips and actuators.

“The institutional ambiguity allows indirect access to restricted technologies without triggering export controls,” making exports much harder to monitor, Cheung said. “A robot sold for ‘biomechanics research’ could end up in autonomous surveillance or targeting systems.”

In 2023, it co-developed an AI-powered inspection robot with Huawei, which the U.S. in 2019 labeled as a Chinese military company and slapped with sweeping technology restrictions. The partnership aimed to build a “next-generation AI being” with “intelligent navigation,” “situational awareness” and voice recognition, Huawei said in a news release at the time.

Unitree also integrates speech-to-text software from iFlytek, a Chinese AI firm added to the U.S. Entity List for mass surveillance and oppression of Muslim minorities. And ZTE, the state-linked telecoms giant that U.S. regulators have labeled a national security threat, has worked with Unitree on 5G-enabled robotics to “empower robots with intelligence,” according to ZTE’s response to an investor question in March.

Such Unitree partnerships “raise concerns about indirect support for surveillance and military activities,” Sunny Cheung said. “It also illustrates how China’s military-civil fusion blurs the line between civilian tech and state power projection.”

In a letter to top Trump administration officials in May, the U.S. House Select Committee on the Chinese Communist Party called Unitree “strategically positioned to integrate its technology across government, telecommunications, and military infrastructure.” Lawmakers described the robotics firm as “central to the PRC’s AI expansion alongside Huawei and SMIC,” the partially state-owned semiconductor manufacturer.

A more recent transaction of note occurred in March, when Tongji University—an institution with a record of bidding for PLA contracts—purchased $1.15 million worth of Unitree products, including 10 of its general-purpose humanoid robots. A local outlet described the deal, which it said followed Tongji’s purchase of $145,000 worth of Unitree quadruped robots in 2021, as “the largest single order by any university, both in volume and value.” Tongji said the purchase was for research and student training.

“The PLA benefits from these universities’ access to foreign technology through academic partnerships and procurement channels that appear benign,” said Sunny Cheung, a China studies fellow at the Jamestown Foundation. China still relies on overseas suppliers for key robotics components, including AI chips and actuators.

“The institutional ambiguity allows indirect access to restricted technologies without triggering export controls,” making exports much harder to monitor, Cheung said. “A robot sold for ‘biomechanics research’ could end up in autonomous surveillance or targeting systems.”

Blacklisted Partners and U.S. Concerns

But Unitree’s defense-industry connections run deeper than just through its university sales.In 2023, it co-developed an AI-powered inspection robot with Huawei, which the U.S. in 2019 labeled as a Chinese military company and slapped with sweeping technology restrictions. The partnership aimed to build a “next-generation AI being” with “intelligent navigation,” “situational awareness” and voice recognition, Huawei said in a news release at the time.

Unitree also integrates speech-to-text software from iFlytek, a Chinese AI firm added to the U.S. Entity List for mass surveillance and oppression of Muslim minorities. And ZTE, the state-linked telecoms giant that U.S. regulators have labeled a national security threat, has worked with Unitree on 5G-enabled robotics to “empower robots with intelligence,” according to ZTE’s response to an investor question in March.

Such Unitree partnerships “raise concerns about indirect support for surveillance and military activities,” Sunny Cheung said. “It also illustrates how China’s military-civil fusion blurs the line between civilian tech and state power projection.”

In a letter to top Trump administration officials in May, the U.S. House Select Committee on the Chinese Communist Party called Unitree “strategically positioned to integrate its technology across government, telecommunications, and military infrastructure.” Lawmakers described the robotics firm as “central to the PRC’s AI expansion alongside Huawei and SMIC,” the partially state-owned semiconductor manufacturer.

Unitree’s corporate partnerships “raise concerns about indirect support for surveillance and military activities. It also illustrates how China’s military-civil fusion blurs the line between civilian tech and state power projection.”

- Sunny Cheung, China studies fellow at the Jamestown Foundation

U.S. lawmakers expressed particular concern about Unitree’s growing American footprint. The company’s robots, they said, operate in some state correctional facilities and have gained access to U.S. telecom networks through FCC equipment authorizations—raising fears about data exposure and remote surveillance. In November 2023, Marines armed and tested a Unitree robot with a rocket launcher themselves.

“The fact that PLA-linked robots are operating in U.S. prisons and even Army facilities should be a wake-up call,” said Rep. John Moolenaar, chair of the House committee. “These machines aren’t just tools—they’re potential surveillance devices backed by the CCP.”

Moolenaar urged officials to “act now to ban and blacklist Unitree before it’s too late.”

“The fact that PLA-linked robots are operating in U.S. prisons and even Army facilities should be a wake-up call,” said Rep. John Moolenaar, chair of the House committee. “These machines aren’t just tools—they’re potential surveillance devices backed by the CCP.”

Moolenaar urged officials to “act now to ban and blacklist Unitree before it’s too late.”

Beijing’s New, ‘All-In’ Tech Era

The same month that U.S. lawmakers issued their warning, Unitree restructured itself into a joint stock limited company—a key step toward a potential IPO.While Unitree hasn’t disclosed when or even whether it plans to list, Forbes reported that the company’s Series C funding round in June valued it at 12 billion yuan, or about $1.7 billion. The round closed with backing from the investment arm of state-owned China Mobile and several state-affiliated funds, according to Chinese media.

For years, collaboration between the PLA and China’s private tech firms was limited, hampered by regulatory burdens, secrecy concerns and the risk of foreign sanctions, said Tai Ming Cheung, the UC San Diego professor. But Chinese leaders have ramped up support in response to U.S. export controls, growing competition and a slowing economy. “The state is going all-in on nurturing these tech companies,” said Austin Wang, especially since Xi’s meetings with firms like Unitree earlier this year.

“State-owned enterprises are investing directly, financial institutions have been instructed to increase capital allocations, and sensitive national datasets are increasingly available to AI firms for training,” Wang said.

Unitree’s ties to Chinese officialdom continue to grow, too. As of this month, Wang Xingxing joined the advisory council to the U.S.-sanctioned chief executive of Hong Kong.

A few years removed now from its pledge against weaponization, his company stands at the forefront both of China’s technological ambitions and of a changing dynamic.

“What we’re witnessing,” Tai Ming Cheung said, “is the deepening militarization of China’s economy.”

Yu-Jie Liao and Kharon research contributed to this report.

Read more from the Kharon Brief: