Last week, the U.S. government announced a significant package of new sanctions and export controls aimed at weakening Russia’s military industrial base, manufacturing sector, and the global web of actors that continue to help the Kremlin evade sanctions.

The new measures, announced to mark Ukraine’s Independence Day, targeted more than 400 entities and individuals. These include companies in Europe, Asia, and other regions involved in the covert procurement and supply of critical goods to Russia.

“Today’s action is an important step forward in bottlenecking the procurement networks Russia has turned to in the face of aggressive U.S. and allied export controls. We will not stop until Russia has nowhere to turn,” said Thea D. Rozman Kendler, the U.S. Assistant Secretary of Commerce for Export Administration.

The latest sanctions are another step towards a coordinated multilateral effort to degrade Russia’s ability to sustain its military operations by preventing Moscow from gaining access to the technology and Common High Priority (CHP) items it needs for its weapons.

Here are seven key takeaways from the latest measures:

1. Sanctions Strike at the Heart of Russia’s Foreign Supply Chains

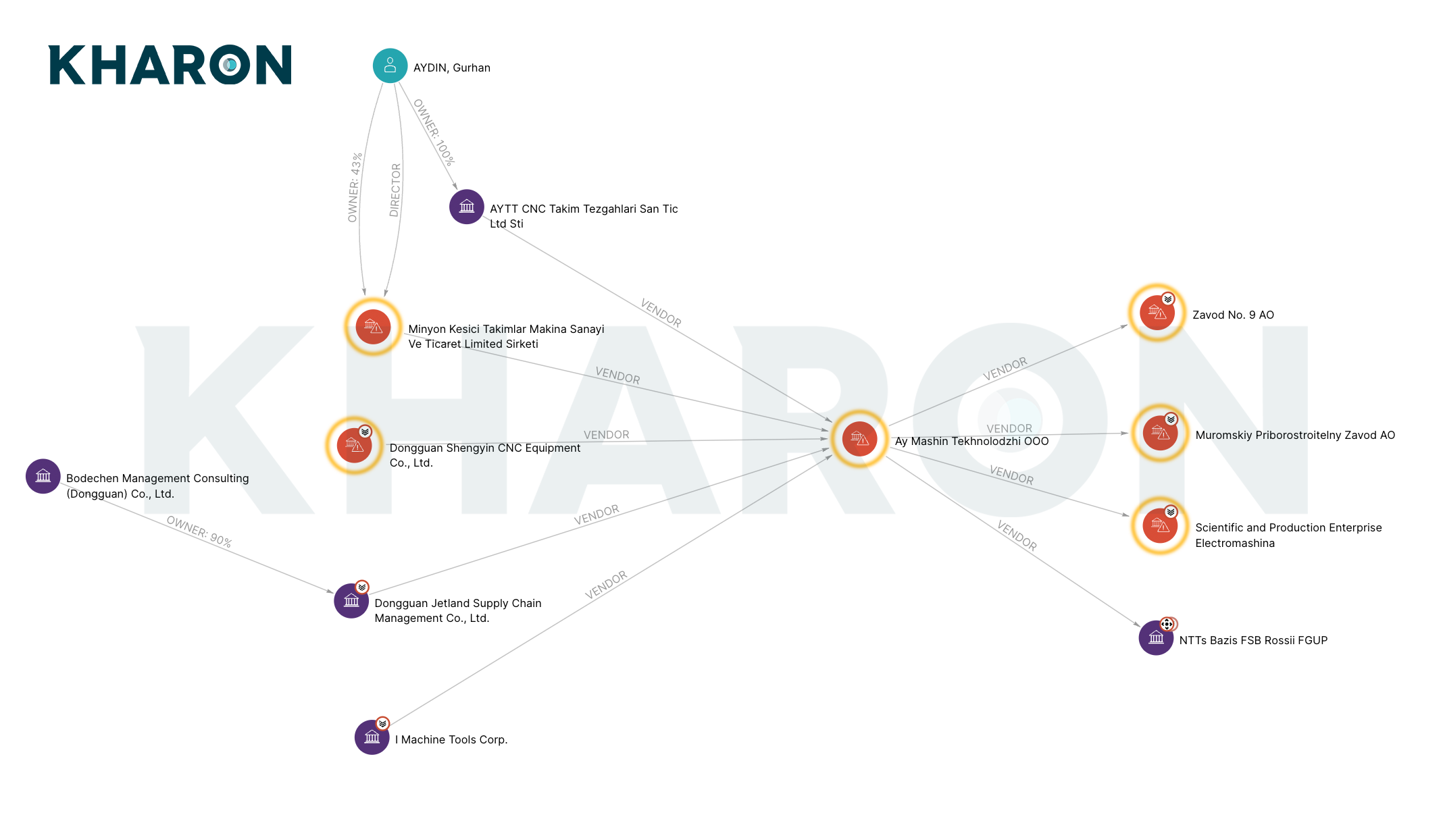

The measures target several international suppliers of critical items linked to Russia’s military industrial base, including exporters and producers of computer numerical control (CNC) machine tools, machining centers, and software to Russian end-users.

Kharon Insight: Among the companies targeted is Dongguan Shengyin CNC Equipment Co LTD, a China-based firm involved in the supply of CHP items to Russian companies in 2023 and 2024. Its clients include Limited Liability Company I Machine Technology, a Russia-based firm sanctioned by the U.S. government in November 2023.

Dongguan Shengyin CNC Equipment Co LTD served as a primary supplier of CHP goods to I Machine Technology and other Russian customers well before its designation last week.

In June, the U.S. Department of the Treasury sanctioned Minyon Kesici, a Türkiye-based supplier of CHP items to I Machine Technology. Several other suppliers of I Machine Technology, based outside of Russia, remain unsanctioned.

2. An Illicit Procurement Network Persists Despite Sanctions and Arrest

The U.S. Department of State sanctioned three companies in Türkiye, Hong Kong, and Russia that are part of an “illicit procurement network” established by Russian national Maxim Marchenko, who was arrested by the FBI in September 2023. Marchenko was arrested and subsequently charged in a U.S. court for money laundering and smuggling dual-use, military-grade microelectronics in support of Russia’s military.

Kharon Insight: Companies associated with Marchenko – including the three most recently designated – continued to source and trade restricted goods in 2024, well after Marchenko was detained by U.S. authorities.

The continuation of Marchenko's network even after his arrest illustrates the resilience and adaptability of Russian illicit procurement channels that operate through complex, multi-hop procurement networks. Dismantling such networks necessitates a broader, risk-based approach to effective compliance and enhanced due diligence practices.

3. A Warning to Facilitators of Sanctions Evasion

The Treasury warned that Russia is attempting to evade sanctions by opening new overseas branches and subsidiaries of its financial institutions. It advised foreign regulators and financial institutions to “be cautious about any dealings” with these entities, even if they are not directly sanctioned.

“Treasury is aware of Russian efforts to facilitate sanctions evasion by opening new overseas branches and subsidiaries of Russian financial institutions. Foreign regulators and financial institutions should be cautious about any dealings with overseas branches or subsidiaries of Russian financial institutions, including efforts to open new branches or subsidiaries of Russian financial institutions that are not themselves sanctioned.” |

U.S. Department of the Treasury, Press Release (August 23, 2024)

In an interview with the Financial Times, U.S. Deputy Treasury Secretary Wally Adeyemo warned countries that they risk secondary sanctions if they allow Russian banks to establish local branches to finance supplies for Russia's military efforts. Adeyemo emphasized that the U.S. would take action against not only these branches but also against other entities in those jurisdictions that collaborate with them.

Last December, the U.S. administration issued an executive order expanding the Treasury's tools to disrupt Russia’s military capacity by authorizing secondary sanctions on foreign financial institutions that aid Russia’s military-industrial base.

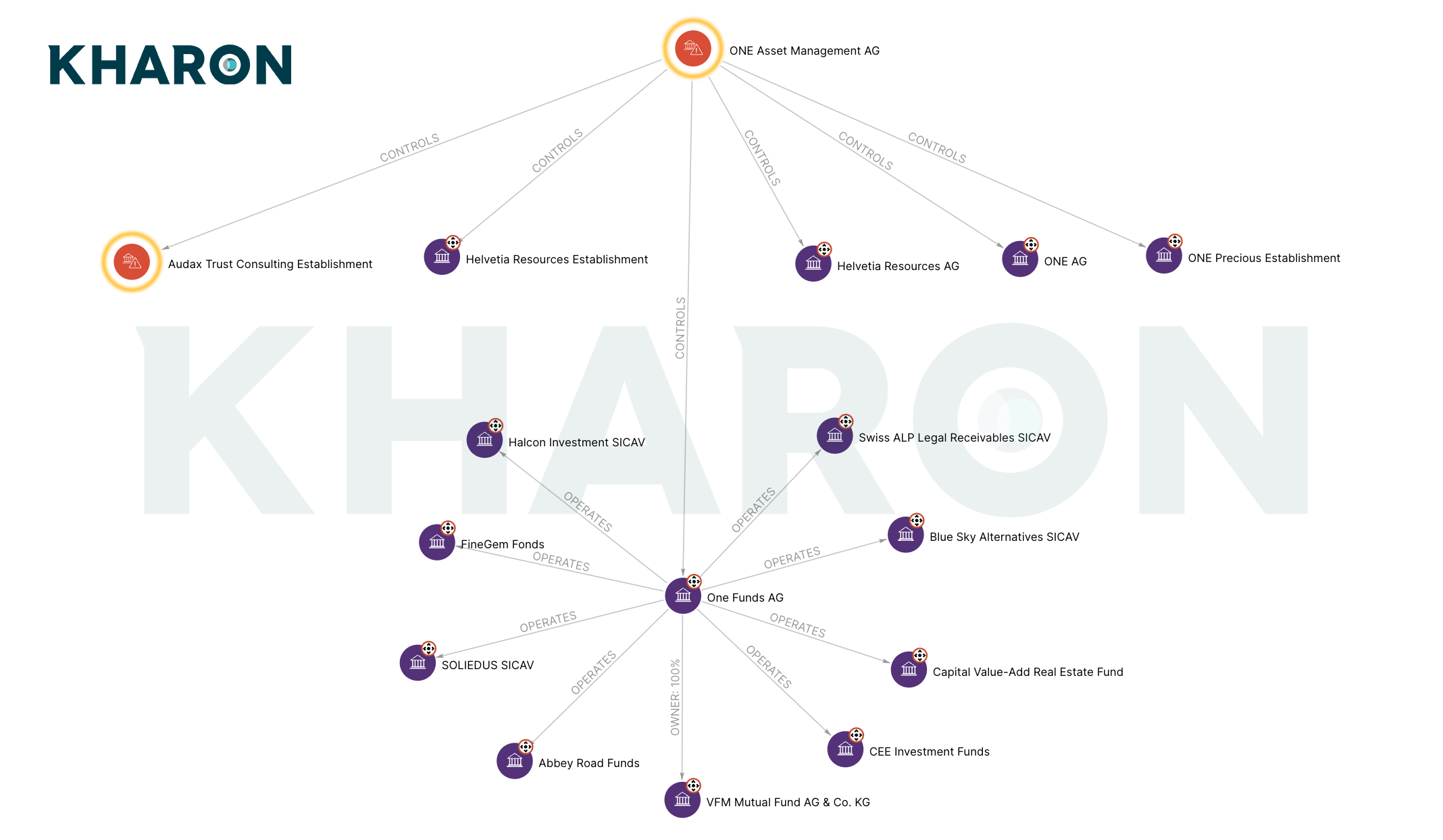

Kharon Insight: Earlier this year, the Treasury noted that sanctioned Russian entities are increasingly turning to smaller banks, wealth management firms, and corporate service providers to evade sanctions and access the international financial system.

These latest sanctions targeted the Liechtenstein-based One Asset Management AG for providing financial and investment advisory services to sanctioned Russian nationals. On its website, One Asset Management AG claims to offer “tailored solutions,” including investment management, commodities distribution, and trading, to clients seeking expertise in managing and reallocating assets. The company operates through several subsidiaries incorporated in Liechtenstein and Switzerland, including One Funds AG, which oversees more than a dozen investment funds in Liechtenstein.

4. Zeroing in on Russia’s Domestic Drone Production Technology

The Departments of State and the Treasury targeted entities and individuals involved in nearly all aspects of unmanned aerial vehicle (UAV) production, including companies contracted to source microcircuits, electronics, and software for use in Russian-manufactured UAVs.

Kharon Insight: One entity designated by the Treasury is Limited Liability Company Dronoport. The company, which operates under the trade name “HIVE,” develops and deploys AI software to train drone platforms to swiftly respond to attacks. The company was investigated by Kharon in May for its involvement in developing Russian UAV systems.

More on the Kharon Brief’s coverage of HIVE and Russia’s drone production networks:

• Russians Imported Millions in Chinese Drone Parts, Some with Western Chips

• Russia’s Tech Incubators Play Key Role in the Country’s Wartime Economy

• Snapshot: Russian Drone Program Collaborates with Iran, Imports Western Tech Despite Sanctions5. Limiting Russia’s Future Revenue from Strategic Metals and Mining Sectors

The sanctions target entities and individuals involved in Russia’s future energy, metals, and mining production and exports. The measures included designations of steel, iron, and coal mining companies as well as auxiliary firms that provide specialized services to Russian metals and mining companies.

This move follows the February 2023 issuance of a new ruling that authorizes sanctions against the metals and mining sectors of the Russian economy.

Kharon Insight: Russia is a leading global producer of oil, natural gas, and minerals, relying heavily on its natural resources as a cornerstone of its economy. While the U.S. and G7 governments have used sanctions and export controls to cut off this vital revenue stream for the Kremlin, Russian-origin gems, critical minerals, and metals continue to find their way into the global market. According to the Russian Federal Customs Service, the export of metals and products made from metals accounted for more than $260 billion in 2023.

Seven of the top 20 companies on the Moscow Stock Exchange (in terms of market capitalization) are in the metals and mining sector. Some of these Russian entities include Polyus PJSC (a gold mining company), Alrosa PJSC (a state-owned diamond mining company), Mechel PAO (a steel manufacturer), and Norilsk Nickel PJSC (a nickel and palladium mining and smelting company).

Norilsk Nickel accounts for roughly 40% of global production of palladium, a metal that has been excluded from U.S. and U.K. export controls targeting the Russian metals industry. Although the company itself has not been subject to sanctions, its ownership chain leads back to several sanctioned oligarchs aligned with the Kremlin, including Oleg Deripaska and Vladimir Potanin.

Between November 2021 and May 2023, Norilsk Nickel shipped more than $960 million worth of platinum and palladium to a subsidiary of a major Japanese automotive manufacturer using affiliated companies in Hong Kong and Switzerland, as well as a now-sanctioned Russian logistics company.

6. Cutting Off Foreign Exporters to Russia

In a coordinated move, the Commerce Department’s Bureau of Industry and Security (BIS) added 123 entities to the Entity List, including 42 in China and Hong Kong and 14 in Türkiye, Iran, and Cyprus, for shipping U.S.-origin and U.S.-branded items to Russia.

BIS also issued guidance to U.S. exporters, advising them to include clauses in their sales contracts to prevent the diversion of items to Russia. BIS notes that the prohibition extends even after the initial sale, and that reexporting certain items to Russia generally requires a license. This approach mirrors the European Union’s “No re-export to Russia” clause, which was announced in December 2023 and mandates similar terms in EU sales contracts.

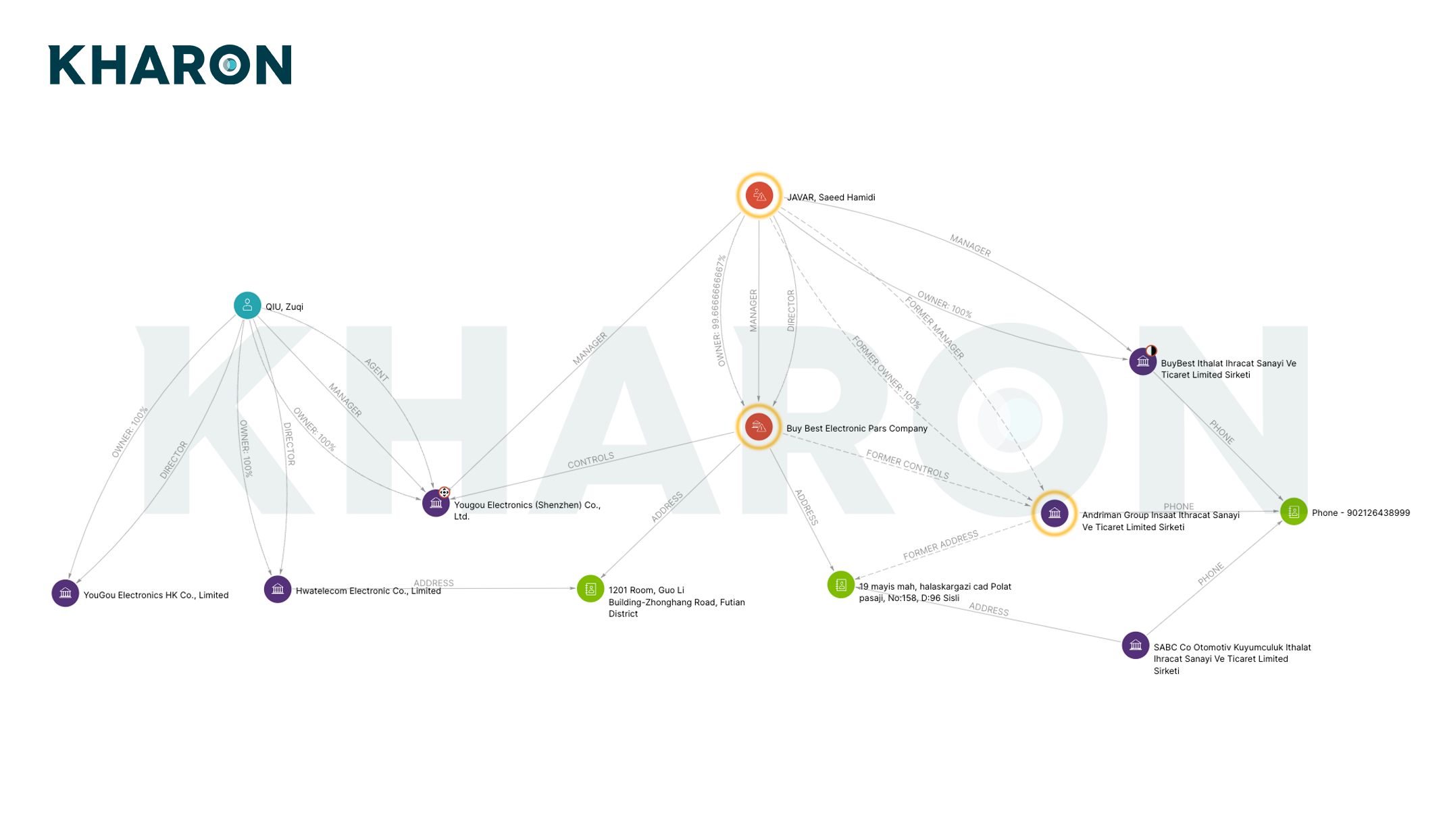

Kharon Insight: In July, the Treasury sanctioned Iranian procurement agent Saeed Hamidi Javar and his electronics supplier company, Buy Best Electronic Pars, for facilitating a front company for Iran’s Ministry of Defense. At the time, a Kharon investigation uncovered multiple companies in Türkiye and China that are affiliated with Javar and Buy Best Electronic Pars. Among these companies is Yougou Electronics (Shenzhen) Co., Ltd., which reports to be a verified distributor of U.S. electronic manufacturers, according to its website. Last week, BIS added Buy Best Electronic Pars and one of the Turkish affiliates Kharon had identified to the Entity List.

7. Further Targeting Diversion Through Shell Companies

Following a trend first introduced in June, BIS also announced the addition of four addresses in Hong Kong and Türkiye to the Entity List due to the high risk of diversion to Russia. Companies using these Entity Listed addresses must now obtain a license for transactions. In new guidance to non-U.S. corporate service providers, BIS advised ensuring that their addresses and services are not used by shell companies to divert prohibited goods to Russia. BIS also urged exporters and financial institutions to screen both the names and addresses of parties involved in export transactions and monitor for “red flags” that may necessitate enhanced due diligence.

Kharon Insight: Since June, BIS has now added 12 addresses in key transshipment hubs, mainly Hong Kong and Türkiye, to its Entity List due to significant shipments of restricted items to Russia. Kharon has identified over 900 companies that are located at these addresses, many of which have exported restricted goods with potential military use to Russia in the past year.

While adding specific addresses to a screening list is a new tactic, the issue of shell companies evading sanctions using common or shared addresses is not novel. For years, these entities have exploited corporate service providers to facilitate unlawful trade, a practice not limited to Russia but also observed in North Korean and Iranian sanctions evasion and weapons proliferation networks.

This underscores the need for enhanced due diligence and screening across financial institutions, foreign exporters, and the corporate services industry.