The Trump administration moved last week to reverse the 2020 acquisition of a Delaware-based audiovisual equipment company that supplies U.S. intelligence agencies, citing threats that it said the deal posed to national security.

The block came as the Trump administration broadens its scrutiny of U.S.-China investments, but this target stood out: Suirui International, the Hong Kong-based company behind the deal, faces no U.S. restrictions to date. Nor does Suirui Group, its China-based majority owner, which Treasury also called out.

Those China connections alone may have doomed Jupiter Systems’ acquisition. But Kharon research also shows that U.S. authorities had previously targeted and sanctioned a close Chinese partner of Suirui over its alleged role in large-scale cyberattacks. And the nature of the companies’ commercial relationship raised further red flags.

Background: The Delaware company, Jupiter Systems, was founded in 1981 and “has been operating as a US company” ever since, according to a statement it released after the Treasury order.

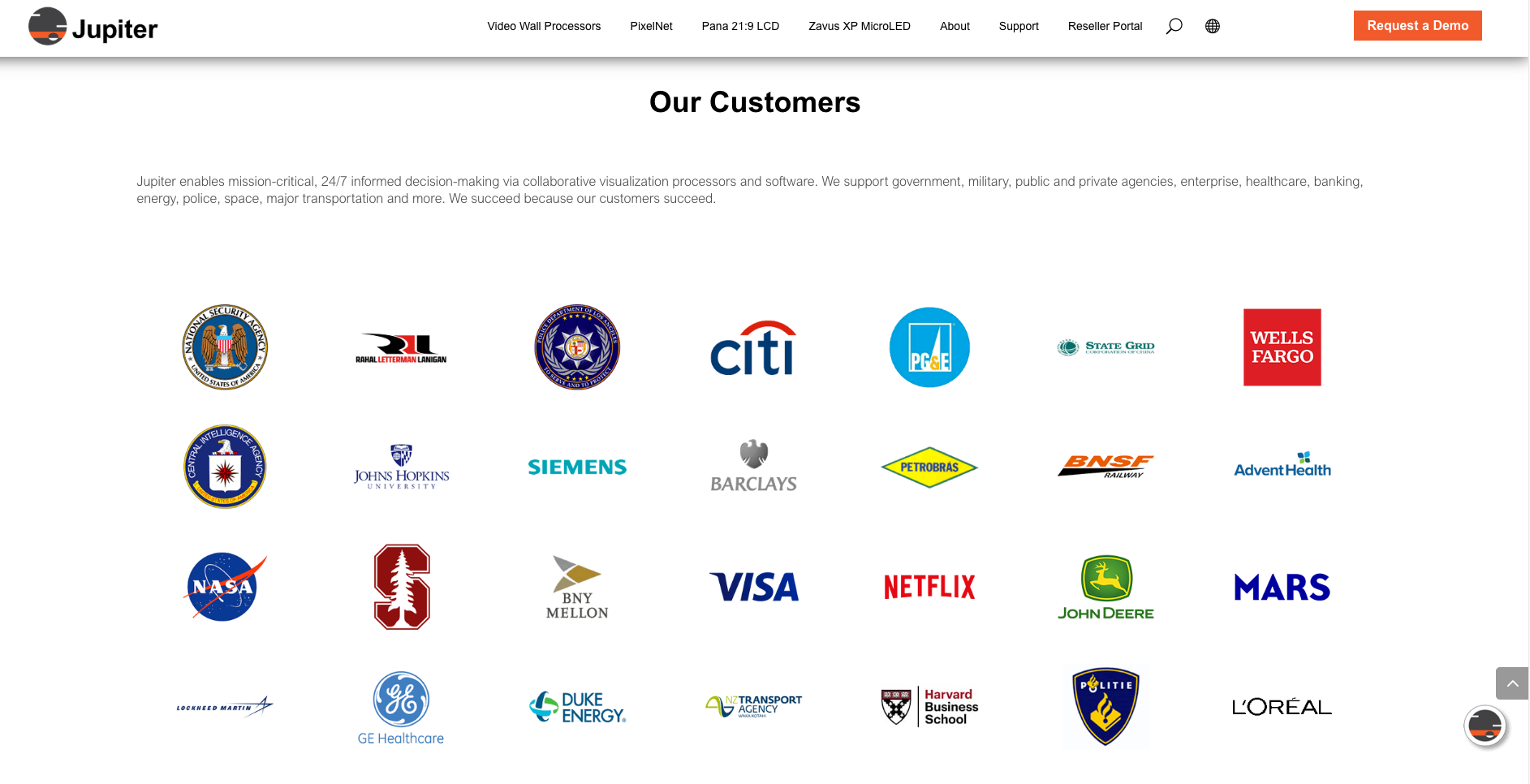

Jupiter Systems focuses, it said, on “developing and manufacturing cutting-edge display wall and control room technologies to mission-critical environments.” According to its website, its customers include the CIA, NSA, NASA and military agencies.

The block came as the Trump administration broadens its scrutiny of U.S.-China investments, but this target stood out: Suirui International, the Hong Kong-based company behind the deal, faces no U.S. restrictions to date. Nor does Suirui Group, its China-based majority owner, which Treasury also called out.

Those China connections alone may have doomed Jupiter Systems’ acquisition. But Kharon research also shows that U.S. authorities had previously targeted and sanctioned a close Chinese partner of Suirui over its alleged role in large-scale cyberattacks. And the nature of the companies’ commercial relationship raised further red flags.

Background: The Delaware company, Jupiter Systems, was founded in 1981 and “has been operating as a US company” ever since, according to a statement it released after the Treasury order.

Jupiter Systems focuses, it said, on “developing and manufacturing cutting-edge display wall and control room technologies to mission-critical environments.” According to its website, its customers include the CIA, NSA, NASA and military agencies.

(Jupiter Systems)

Jupiter Systems’ business scope tracks closely with that of Suirui, a video-conferencing company whose founder and CEO previously worked at Microsoft.

But, on Friday, the Committee on Foreign Investment in the United States (CFIUS) said the Jupiter-Suirui deal risked “the potential compromise of Jupiter’s products used in military and critical infrastructure environments,” without specifying further. It ordered Suirui and Jupiter Systems to divest within 120 days.

Key partner: The acquisition’s undoing may connect to a different government action, from last year.

In September, the Justice Department announced that an operation had successfully “disrupted a botnet consisting of more than 200,000 consumer devices in the United States and worldwide.” The devices, it said, were “infected” by Chinese “state-sponsored hackers working for Integrity Technology Group, a company based in Beijing, and known to the private sector as ‘Flax Typhoon.’”

Treasury followed up this past January by sanctioning Integrity Technology for supporting Chinese state-linked cyberattacks—including, notably, intrusions into U.S. government systems.

Integrity hasn’t disclosed much information on its supply chain since 2021, when it was preparing for its initial public offering in Shanghai. But its prospectus at the time detailed its customer base, including a host of Chinese military and police users.

And one of Integrity’s top suppliers for the previous three years running, it said, was Suirui Group.

But, on Friday, the Committee on Foreign Investment in the United States (CFIUS) said the Jupiter-Suirui deal risked “the potential compromise of Jupiter’s products used in military and critical infrastructure environments,” without specifying further. It ordered Suirui and Jupiter Systems to divest within 120 days.

Key partner: The acquisition’s undoing may connect to a different government action, from last year.

In September, the Justice Department announced that an operation had successfully “disrupted a botnet consisting of more than 200,000 consumer devices in the United States and worldwide.” The devices, it said, were “infected” by Chinese “state-sponsored hackers working for Integrity Technology Group, a company based in Beijing, and known to the private sector as ‘Flax Typhoon.’”

Treasury followed up this past January by sanctioning Integrity Technology for supporting Chinese state-linked cyberattacks—including, notably, intrusions into U.S. government systems.

Integrity hasn’t disclosed much information on its supply chain since 2021, when it was preparing for its initial public offering in Shanghai. But its prospectus at the time detailed its customer base, including a host of Chinese military and police users.

And one of Integrity’s top suppliers for the previous three years running, it said, was Suirui Group.

Kharon users can explore this Insight in greater detail through the ClearView platform.

The relationship: According to the prospectus, Suirui provided Integrity with “application vulnerability discovery and exploitation services,” “intelligence sharing,” and “application security monitoring.” Such services can be employed in cybersecurity and vulnerability reporting, and they appear to be outside of Suirui’s primary business scope. That presents a big red flag, considering the accusations against Integrity and the government relationships that Jupiter Systems has.

The scale of those transactions adds to it: Integrity’s prospectus said that Suirui was its No. 1 supplier in 2020 and its No. 3 supplier in 2019 and 2021.

The bottom line: In a February fact sheet on foreign investment, the White House said it would take action to “prevent foreign malign actors from gaining access to United States information networks.”

The Jupiter-Suirui block, issued five years after the deal took place, offers an early, aggressive signal of how the Trump administration sees Chinese investment risk—and how it intends to respond.

Read more on China and investment:

The scale of those transactions adds to it: Integrity’s prospectus said that Suirui was its No. 1 supplier in 2020 and its No. 3 supplier in 2019 and 2021.

The bottom line: In a February fact sheet on foreign investment, the White House said it would take action to “prevent foreign malign actors from gaining access to United States information networks.”

The Jupiter-Suirui block, issued five years after the deal took place, offers an early, aggressive signal of how the Trump administration sees Chinese investment risk—and how it intends to respond.

Read more on China and investment: